The New South Wales Independent Regulatory and Pricing Tribunal (IPART) has announced its draft determination on a ‘fair and reasonable price’ for grid-connected solar photovoltaic (PV) systems today. The voluntary 8-10c per kilowatt-hour (kWh) rate is significantly less than the mandatory, minimum 1-to-1 solar feed-in tariff rate that the state’s solar industry had been pushing for, in which grid-fed solar power would be valued at the same rate as the retail tariffs paid by households for electricity from the grid. IPART’s will not be released until April 2012, after submissions from the public in response to the draft have been evaluated and taken into consideration.

IPART’s ‘fair and reasonable’ draft value for solar electricity

As discussed previously, the terms of reference set by the NSW government when it requested IPART’s input on the matter of how to determine a ‘fair and reasonable value’ included that 1) it will not benefit from government funding and 2) it must not result in a price increase for retail electricity customers in the state–it will be a wholly unsubsidised scheme. This means that, unlike the previous NSW 60c/kWh feed-in tariff and the other feed-in tariffs offered in the Australian States and Territories, if the draft determination proceeds unchanged, the government will not be making any contributions to encourage the uptake of small-scale solar power among the state’s residents. Customers will be paid for what their solar electricity is worth to the network. This will certainly be a step up from the current situation; at the moment, some NSW electricity retailers are offering either nothing or a nominal 6c/kWh for grid-fed solar.

IPART’s conclusions about the value of solar power to electricity retailers is comparable to that arrived at by South Australia‘s IPART equivalent, ESCOSA, in the recent determination of the mandatory retailer contribution for solar power. The key difference between the two states’ schemes is, however, that in SA there will also be a government contribution of 16c/kWh, funded by tax revenues, to incentivise the the uptake of solar power. This rate is additional to any mandatory retailer contribution, which was recommended at 7.1c/kWh for the period between 27 Jan and 30 June 2012. As in South Australia, the rate in NSW will increase as with its real value to electricity distributors; this value is expected to rise with the implementation of carbon pricing next year.

How should the new Solar Feed-in Tariff be implemented?

In its determination, IPART has made no stipulation that the the payment of the feed-in tariff by electricity retailers to their customers should be mandatory. Instead, it recommends that the government, electricity distributors, and solar power companies themselves facilitate greater understanding of how the mechanisms of electricity pricing and feed-in tariff rate determination function, as well as what customer options are with regard to payments for solar electricity.

Competition between retailers for solar customers to drive residential solar PV uptake?

The theory behind this component of IPART’s draft recommendation is that, if electricity customers are aware of their options and an annually set ‘benchmark range’ for the feed-in tariff (one idea proposed by IPART), this will foster competition among retailers, as customers will be empowered with the knowledge of what solar electricity is worth. This market-based approach will avoid the need for government intervention. This is why the tribunal has also recommended a customer education campaign in conjunction with the implementation of the state’s new solar FiT system. Whether this will work out in actuality is a question that remains to be answered, however. As it stands at the moment, NSW has no mandated feed-in tariff, and ‘competition’ between retailers for solar customers has not resulted in better deals for solar customers.

Read IPART’s consumer fact sheet about the NSW solar feed-in tariff draft determination (pdf)

The benefits of going solar in NSW will remain savings on power bills

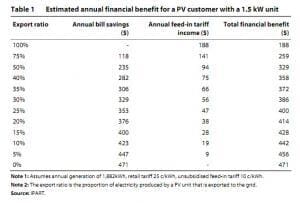

The benefits of solar power in NSW in the absence of a feed-in tariff incentive scheme lie in its ability to reduce home power bills. Previously, the incentive was in the benefits that owning and operating a small-scale system offered through the Solar Bonus Scheme. These benefits were unquestionable–60c were paid for every kWh produced by grid-connect solar systems. On a net feed-in tariff of less than 1/6 this amount, the incentives are significantly weaker, but still significant, especially in light of expected electricity price increases in the state and the falling cost of small-scale PV systems across the country. The table below (from the IPART fact sheet (pdf)) details the estimated financial benefits for a PV customer witha 1.5kW solar system.

Estimated financial benefit for NSW customers with a 1.5kW solar PV system. (Click to see enlarged image.)

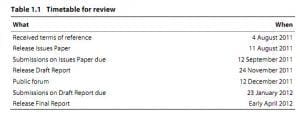

Final determination not due until April

It is important to keep in mind that, although the future of the NSW FiT is a topic of interest being keenly watched by a wide array of stakeholders, including government, solar companies, and solar customers, IPART’s draft determination is still only a draft, and will remain as such until the final report is issued in April 2012. A public forum/roundtable discussion will be held on 12 December 2011 about the draft proposal, and submissions regarding it will be accepted until 23 January 2012. Stakeholders are invited to make written submissions until this date.

IPART NSW Solar Feed-in Tariff review timetable. (Click to see enlarged image.)

© 2011 Solar Choice Pty Ltd

Other resources:

IPART ‘Solar feed-in tariffs’ page

Infographic highlighting key points from the IPART review by Nigel Morris of Solar Business Services

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

- Enphase Battery: An Independent Review by Solar Choice - 20 January, 2024

- Can I add more panels to my existing solar system? - 8 August, 2023

I would suggest you demand your supplier change you over to a nett meter and if you dont get it them you go to the ombudsman in NSW its Ewon and the number is 1800246545, Good luck.

If i rewired my power to bypass the meter, I would be fined for power theft, although it seems all right to sell the power that I produce and get nothing for it–power theft.

I have a 1.5kw system installed before last year’s cancelled rebate but not connected to grid until after this date. Because our system was ordered months before the cut off date it was ordered with a gross meter. I receive nothing for my elec generated so the system has cost me nothing but money. How do I get paid for what I generate–this is grossly unfair. What happens when all the current people under subsidies come off subsidies is the elec company going to get all this elec for free beccause that is what is happening to people caught in the web as I have been. Hoping you can help. We live in South Nowra and are told that because we are under actalew in ACT they dont have to pay us a cent. Why are we being penalised becuase our power is under act becuase of jervis bay. Please any help you can give me to get some money for my power would be appreciated as we are aged pensioners and put this in to help with the bills.

Hi Bev,

On a gross meter the electricity from your system goes directly into the grid. You do not have the option for self-consumption. NSW residents with solar have been given a raw deal compared to what most other states offer in terms of solar feed-in tariffs.

However, there are options out there. f you want to make the system worthwhile for yourselves, this is what they are:

1) See if you can switch to AGL NSW as opposed to ActewAGL as your retailer. As we understand it, AGL NSW offers 28c/kWh for solar feeders-in. Call them up and see if you can switch and if they’ll allow you to receive the 28c/kWh.

2) If that turns out to not be an option, make it a priority to have a net meter installed. This will unfortunately cost you $300-$500, but it will give you the choice of self-use of your solar power, which will enable you to save money in the long run. It would afford you significant benefit in terms of electricity bill savings, provided you time your electricity use to coincide with the periods in which your system is generating electricity–something you should be able to do relatively easily assuming that you are home during the day. By doing this you will avoid the need to purchase electricity from the grid, saving you the equivalent of ActewAGL’s retail electricity tariff for each unit of energy you produce and use yourself.

Given that you’re not on the feed-in tariff, you’re actually fortunate to have bought a relatively small system–if it were a system that was larger and generated more than what you would ordinarily consume in the course of a day, the excess would go to waste.

I hope this has been helpful. Good luck!

IPART – ( Independent Pricing and Regulatory Tribunal) has been directed by the state government to meet certain conditions.

Is there a conflict between the government’s directive as to IPART’s recommendations and the independence of the supposedly “Independent Pricing and Regulatory Tribunal” .

The very fact that IPART has received a directive relating in part to what its findings will be or won’t be, confirms that the INDEPENDENT Pricing and Regulatory Tribunal is under political influence and therefore NOT INDEPENDENT.

The public has reason to be very concerned.

It would be interesting to note the reaction of power companies and the NSW State Government should all households supplying solar power to the grid, switch off their solar input, even if only for one nominated day.

My suspicion is that then, and only then, would the value of solar inputs be appreciated.

Being a cynic, I suspect political interference in IPART’s deliberations. After all, it is a body set up by the government. Its members are also, no doubt, appointed by the government and not unnaturally want to serve their political masters. I suspect that they are very well remunerated and wish to retain their positions.