Speculation that the market for storage solutions for solar photovoltaics (PV) is poised for huge growth has been given some additional credence thanks to a recent report published by IMS Research. The report, called “The role of energy storage in the PV industry“, anticipates a global energy storage market for grid-connected solar PV systems worth $19 billion by 2017–up from under $200 million in in 2012.

It will come as little surprise to anyone who follows the story of the solar PV market’s rapid global expansion that Germany–the undisputed world leader in rooftop solar installations–will be the champion of energy storage solutions, with around 70% of the market anticipated to be located within its borders in 2017. As with solar PV, Germany’s leadership on this front is likely to impact other solar energy storage markets across the globe.

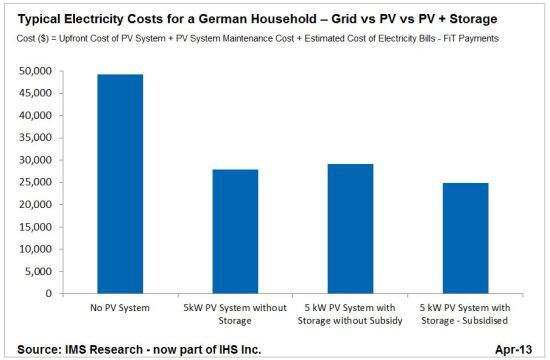

Much of this growth will be thanks to a subsidy that the Germany government has introduced to encourage the uptake of grid-connected energy storage. The incentive scheme, which takes effect from 1 May 2013, will cut around 30% off the cost of installing an energy storage system for households who make the move to solar. In the long run, it will also make it a smarter investment to install a solar system with an energy storage system than to install one without; according to IMS, the subsidy will “reduce the average 20-year cost of a PV system with storage to 10 percent less than a system without it.”

(Table via IMS Research, via Solarlove.)

It is expected that, as happened with solar PV, technology costs will fall with more widespread adoption, allowing incentives to eventually be scaled back. Over the next 5 years, IMS anticipates that around 2 gigawatt-hours (GWh) of solar storage capacity could be installed in Germany alone–several orders of magnitude greater than the approximately 8 megawatt-hours (MWh) currently installed in 2013.

In addition to helping households and small businesses to save money on their electricity bills, there will also be significant growth in the utility-scale market for energy storage. Right around the same time as the release of the IMS report, Berlin startup company Younikos announced that it will be developing, in conjunction with renewable energy utility Wemag AG, a 5 megawatt-hour (MWh) battery park in West Mecklenburg; Samsung SDI will be providing the batteries for the park. This announcement comes on the heels of the news that Japan will be building the world’s largest battery bank in Hokkaido–mainly to deal with excess solar energy production on the island.

Interest in energy storage solutions in Australia has been growing over the past few years as electricity prices have risen; many homes have considered going ‘off grid’ to escape their seemingly inexorable rise. Although energy storage solutions are not yet affordable here (and the government seems unlikely to introduce a comprehensive strategy to change this), conditions in many states are actually almost ripe for such technologies to take off. Counterintuitively, this is because of the lack of government support for solar PV in the form of solar feed-in tariffs, which encourage the export of unused solar energy to the electricity grid.

Feed-in tariff rates in many states are now around 8c per kilowatt-hour (kWh), which is significantly lower than what it costs to purchase electricity from the grid. This means that it is wiser for solar households and businesses to use their solar power themselves–which is generally only possible if someone is occupying the building during the daytime. A solar energy storage system would allow solar system owners to store their power for later use–but they would only consider installing one if it makes financial sense to do so.

Germany’s introduction of the energy storage incentive appears to be a result of extremely well thought out policy and long-term planning. The German feed-in tariff is designed to be periodically and gradually reduced as more and more homes and businesses sign on to the scheme. The feed-in tariff rate, once extremely generous, has just recently dipped so low as to be below the retail cost of electricity in the country–meaning that the market is primed for greater uptake of energy storage. Making it affordable for the average household or business by introducing a subsidy just at this point is a stroke of genius that could only have been so smoothly executed given the previous decade’s worth of carefully crafted energy policy scaffolding.

Since such comprehensive policy is not likely to be adopted in Australia, the best that those in the industry–and those with an interested in gaining a greater degree of ‘energy independence’–can realistically hope for is that the benefits Germany’s leadership spill over in the form of more affordable energy storage.

Top image: Kyocera’s energy management & storage solution

© 2013 Solar Choice Pty Ltd

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

- Enphase Battery: An Independent Review by Solar Choice - 20 January, 2024

- Can I add more panels to my existing solar system? - 8 August, 2023