South Australia’s independent industry regulatory body–The Essential Services Commission of South Australia, or ESCOSA–has released a draft determination about its recommendations for the electricity retailers’ contribution to the state’s Transitional Solar Feed-in Tariff. From 27 January 2012 , the retailers’ contribution will be offered in addition to the 16c per kilowatt-hour (kWh) currently offered to solar customers.

The new South Australia Transitional Feed-in Tariff: 23c/kWh for 2012

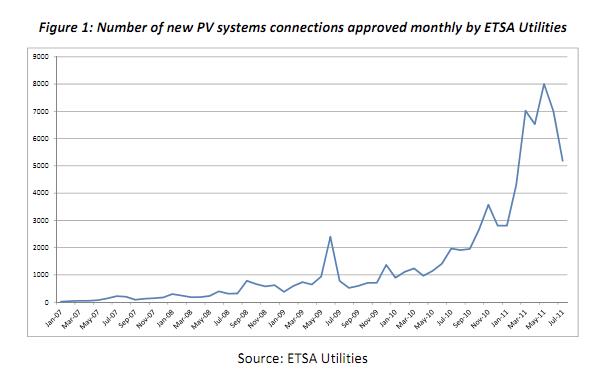

Since its introduction, the South Australia Solar Feed-in Tariff scheme has given a strong incentive for South Australians to install solar power, with over 47,000 premises signed up under the FiT scheme, resulting in a cumulative capacity of 120 megawatts (MW) of solar installed in the state. Until 30 September 2011, the rate for solar power fed into the grid was a generous 44c/kWh, which made going solar a financially viable option for many households and businesses in the state. Although less generous than previously, South Australia still has one of the highest Solar Feed-in Tariffs in Australia.

South Australian residents who apply for the state’s Transitional Solar Feed-in Tariff between 27 January 2012 and 30 June 2012 will be offered at least (16c/kWh + 7.1c/kWh =) 23c/kWh for every unit of electricity exported to the grid. Although a smaller amount than the previous 44c/kWh rate, the mechanism used to arrive at this new rate is slightly more complicated than it was before, and may mean more paperwork for new grid-connect solar customers.

How does South Australia’s Transitional Solar Feed-in Tariff scheme work?

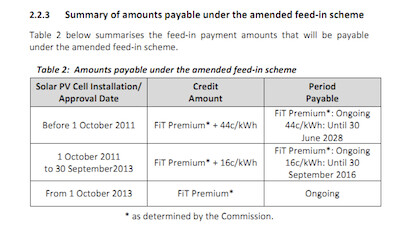

The South Australia Feed-in Tariff was until 30 September 2011 offered at a rate of 44c/kWh on a net feed-in scheme, meaning that electricity customers with eligible grid-connect solar systems would be paid 44c for each kWh exported to the electrical grid, with no obligatory contribution from electricity retailers. Since the closure of the scheme (which coincided with the end of Victoria’s Premium Feed-in Tariff program), a transitionary feed-in tariff program has come into effect and the format of the incentive has changed, with the government now mandating a significantly reduced rate of 16c/kWh (a rate determined by ETSA Utilities), plus requiring a set contribution from electricity retailers who accept solar customers (a rate determined by ESCOSA).

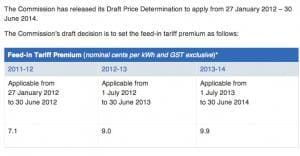

South Australia Transitional Feed-in Tariff Premium Rates Draft Determination until 2014.

As the rate for South Australia’s retailer contribution is meant to reflect the ‘real value’ of solar power to the electricity grid, ESCOSA initially modelled two separate outcomes for for the Feed-in Tariff Premium: one with a carbon price, and one with no carbon price. Since the recent passing of the carbon price legislation in the Australian Parliament, ESCOSA has removed the ‘no carbon price’ model from its projections and has made a clear determination as to what the retailer contribution should be. As the carbon price is expected to drive up the cost of fossil fuel-fired generation, under a carbon price scenario the retailer contribution rate to be offered will be higher than without. The chart to the right (from the ESCOSA report) details these rates for the next 3 years.

How will the two components of the SA Transitional Solar Feed-in Tariff scheme change over time?

The Future of the South Australia Solar Feed-in Tariff

The 16c/kWh rate will apply to customers with eligible solar systems who sign up for the scheme between now and 30 September 2013. Those who apply by this deadline will be eligible to continue receiving this rate until 30 September 2016, whereas the retailers’ contribution will continue indefinitely. Those who sign up after 30 September 2013 and before 30 September 2016 will (unless the government introduces new solar incentive policy) only be eligible for the retailer’s contribution, whose rate will be reassessed annually until the end of the scheme. The retailer’s contribution is expected to continue on in this way into the near future.

Further reading

Solar Choice articles about the South Australia Feed-in Tariff

Feed-in Tariffs across Australia

SA.gov.au: Solar Feed-in Scheme

ESCOSA Draft Report on the price for the Feed-in Tariff Premium (pdf)

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

What is the likelyhood of the State Government abandoning the FIT Scheme altogether after September 2016?

Thanks for the comment, Steve.

I wouldn’t be surprised if the government abandons the mandated 16c/kWh rate, but continued the minimum retailer contribution in some form or another. More likely, though, they’ll likely follow the path of NSW and let the electricity retailers decide how much they want to pay for solar power themselves. Hopefully at that point the retailers will recognise its value and compete for solar customers.

More likely, however, SA will become an offset market–with solar power being so cheap in a few years that no one will think much of installing a system on their home or business to reduce the amount of electricity they purchase from the grid and hence their power bills. In such a situation, there is really little need for government subsidisation in the first place. The incentives that are currently in place should act as something of a bridge towards an unsubsidised future, and they seem to be more or less doing the job–not that the industry doesn’t still need support.

I am having a 3.5kw system installed Mon 4/6/12.

I will be on 16c + 7c from AGL.

Question: Does the 7c from supplier (AGL)stay the same over the years or does it increase each year.

Hi Waylon. The 7c will go up gradually, as it is meant to reflect the ‘actual value’ of the solar power to electricity retailers. The increases will be reviewed annually, but will probably be in the range of 1-2c/kWh per year.

AGL pays me 8 cents a unit and immediately sells it for up to 29 cents per unit with absolutely no effort on their part. They save having to buy a unit from ETSA. What is the average price they pay ETSA? Is it also about 8 cents per unit? This would explain why they only pay me 8 cents / unit. The govt subsidy for new installations has been dropped to 16 cents. when this was first announced the price per unit of electricity was about 24 cents. 16 + 8 = 24. This seems as if the govt is making up the difference in what AGL should be paying and what they are paying. It could be said therefore that the govt is actually subsidising AGP and not the consumer. Am I wrong?

Hi Lyonel,

As noted in the article, the government does not actually subsidise electricity customers or electricity retailers. The government-mandated 16c/kWh for solar power is subsidised by anyone who uses electricity. (SA’s Solar Feed-in Tariff is only expected to account for about 6% of the projected electricity price rises in the coming years.)

Essentially, this 16c/kWh is the government-mandated subsidy, while the minimum retailer contribution (currently 8c/kWh) is what ESCOSA has determined the solar power is actually worth in terms of its usefulness to electricity retailers. The SA Solar Feed-in Tariff scheme is therefore a hybrid scheme. It is unique in Australia in that its structure clearly details the difference between what is subsidisation and what the retailers should be paying for anyhow–Solar power does have quantifiable benefits to the grid, but most states don’t bother to acknowledge these. (Although IPART in NSW recently made a recommendation as to the value of solar PV, it is nominal and–unlike SA–there is no minimum that retailers must pay.)

I strongly object to the statement that ” the state government gives to solar customers.”

The FiT is paid by consumers who may or may not have access to PV electricity.

Apart from mandating it the state government has no input.

Hi Phil,

Thank you for your feedback. The article has been amended accordingly.