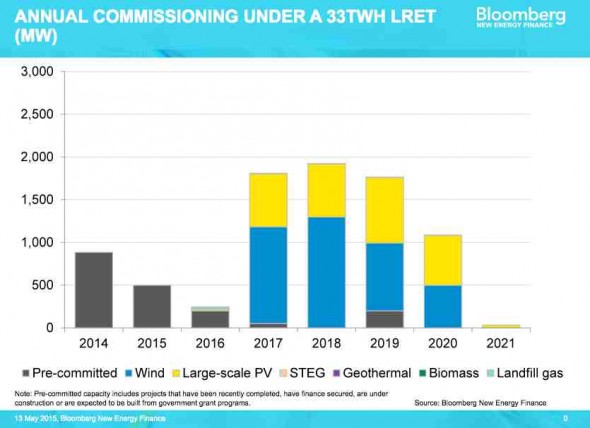

Big solar could take up as much as 40 per cent of Australia’s 2020 Renewable Energy Target, even with a much reduced target of 33,000GWh, according to Bloomberg New Energy Finance.

The forecast contradicts sector-wide fears that large-scale solar projects would be sidelined by cheaper wind energy projects under the agreed cut in the RET.

But BNEF, the leading independent analysis firm in the renewable sector, says the economics of large-scale solar PV are quite strong and that by 2019 and 2020, the bulk of new capacity will come from large-scale solar PV, rather than wind energy.

By 2021, BNEF expects 3,724MW of new wind to be built and 2,638MW of new large-scale solar. This would result in – including current capacity – total capacity of 8.27GW of wind and 2.90GW of large-scale solar in Australia in 2021.

By 2021, BNEF expects 3,724MW of new wind to be built and 2,638MW of new large-scale solar. This would result in – including current capacity – total capacity of 8.27GW of wind and 2.90GW of large-scale solar in Australia in 2021.

BNEF Australia chief Kobad Bhavnagri said the big growth area in Australia is Queensland. That’s because it has no wind energy and few competing new wind projects. It is also the one state in the market that has increasing demand profile, thanks to its big developments in liquefied natural gas.

(The WA market is also confident that some big solar projects will be met because of the high price of energy in that state).

Bhavnagri said this, and Queensland’s excellent solar resources, mean that by 2017, the price of a renewable energy certificate may only need to be around $30/megawatt hour. The price needed to support a wind energy project in NSW might be twice that much.

“We think that solar PV will come in front in Queensland,” Bhavnagri said. Although he added that it would also depend on whether it gets a premium from off-takers, reflecting its ability to deliver during daytime, and if the solar pipeline was ready.

There are several major solar projects with planning approval in the state, although it is not yet clear whether they will get finance. That will depend on the price of power purchase agreements. But one developer told RenewEconomy that he was confident his project would still go ahead in a 33,000GWh target.

However, Bhavnagri said the success of the LRET depended on policy certainty, and the decision by the Coalition government would mean the industry would suffer the same problems of the last 18 months, when the industry had become “uninvestable” because of the policy uncertainty.

The Coalition agreed to a reduced target of 33,000GWh with Labor – down from 41,000GWh – but then backflipped on its promise to delay the next review till at least 2018, or 2020.

Bhavnagri said the policy uncertainty had been entirely responsible for the investment drought, with the only projects to be built supported by other agencies, such as the CEFC and ARENA, that the Coalition intends to dismantle.

© 2015 Solar Choice Pty Ltd