“Is the Renewable Energy Target going to survive this review in reasonably good shape?” There are only so many times you can shake the Magic 8 Ball to try to get the answer you want before you start taking its responses to heart. When it comes to the embattled RET since the Coalition government took over, our Magic 8 Ball’s responses have devolved from ambiguous ones like “Reply hazy try again” and “Ask again later” to “Don’t count on it” and “Very doubtful”. But with Joe Hockey’s recent comments about wind turbines being ‘utterly offensive’ and outright doing away with the Clean Energy Regulator, I don’t know about yours but my 8 Ball keeps coming up with the ominous and dire “My sources say no”.

No one in the renewable energy industry in Australia is taking this lightly–or sitting down, for that matter. The solar industry and solar households, the primary beneficiaries of the small-scale RET, seem to be in the most precarious position with the most to lose should any dilution of the scheme eventuate. As the Australian Solar Council pointed out in their WA campaign, the RET means access to affordable electricity for households across the country–and not just the wealthy ones. There’s now enough solar PV and solar hot water on roofs in Australia to displace the output of a 1GW coal-fired power plant, and in the long run having more renewables on the grid will keep power bills down for everyone. And all in great part to homes and businesses opting to–in effect–invest their own money in the nation’s electricity infrastructure.

When one considers that the Coalition appears open to scrapping the scheme entirely in spite of this and despite the investments that would be left in the lurch if significant alterations to the scheme were to eventuate, it is difficult to be optimistic. So it makes sense to take a look at one (unfortunately) likely outcome of the RET review: the elimination of the SRES–the segment of the RET that supports renewable energy generators up to 100kW in capacity.

How much could solar system prices increase if the small-scale RET gets demolished?

How the SRES reduces solar system prices

How the SRES reduces solar system prices

For those not familiar with how the scheme works, the SRES (Small-scale Renewable Energy Scheme) subsidises the installation of solar PV systems (and other renewable energy technologies) with what is in effect an up-front ‘discount’ of the full cost. The subsidy is not literally a discount (and apparently regulators do not like the way the term is sometimes bandied about), but instead a sort of renewable energy currency–when a system is commissioned by an accredited individual or installation company, it is eligible to create a certain number of Renewable Energy Certificates (RECs, also known as Small-scale Technology Certificates or STCs) depending on the size of the system and the climate of the location where it is installed. The value of a REC is determined by market demand (the RET mandates that big polluters acquire a certain number of them annually–and hence a market is born). In most cases solar installation companies will assume the liability for the RECs and subtract their value from the gross system installation price–which is why many people refer to it as a discount.

Solar system prices without the SRES

The SRES has played an essential role in making solar PV affordable for Australian households, and currently remains the primary incentive mechanism for small-scale solar power in the country. In fact, the SRES is what has allowed Australia to become the distributed solar powerhouse that it has in recent years. Thanks to the RET, Australia has some of the lowest solar installation prices in the world.

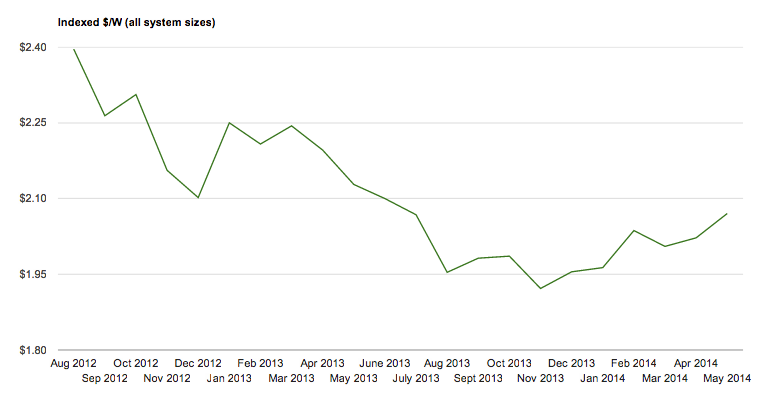

Solar Choice publishes solar PV system prices from its installer network database on a monthly basis, taking into account the STC incentive that installers routinely incorporate. As we’ve pointed out previously, STCs consistently account for a price reduction of about 71¢ per watt (W) of installed capacity in ‘Zone 3’ regions (for example, Sydney, Canberra, Adelaide, Perth and Brisbane) and 61¢/W in Zone 4 regions (Melbourne and Hobart).

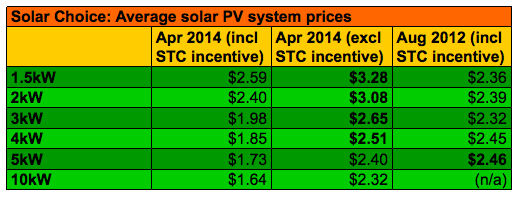

To get an idea of how far the RET has taken us, the table below shows average solar PV system prices (in $/W terms) for March 2014. The first column shows current average system prices (from April 2014) with STC value included, while the second column shows the prices for the month if the SRES didn’t exist. The third column contains subsidised solar system prices from August 2012, when Solar Choice began keeping records. (Figures reflect non-weighted average prices for all of Australia’s major cities mentioned above.)

The comparison is interesting for a number of reasons. Firstly, it shows just how dramatically solar PV system pricing has changed in the last 20 months–nearly 2 years. The long and short of it is that they have come down substantially for 3kW, 4kW and 5kW systems. The second thing that stands out is that the removal of the SRES scheme in its entirety would effectively erase progress on pricing for 3kW-5kW solar systems (now the more popular range of system size) made during this 20-month period. For 1.5kW and 2kW systems, prices would actually move in retrograde, spiking beyond what they were back in August 2012.

The comparison is interesting for a number of reasons. Firstly, it shows just how dramatically solar PV system pricing has changed in the last 20 months–nearly 2 years. The long and short of it is that they have come down substantially for 3kW, 4kW and 5kW systems. The second thing that stands out is that the removal of the SRES scheme in its entirety would effectively erase progress on pricing for 3kW-5kW solar systems (now the more popular range of system size) made during this 20-month period. For 1.5kW and 2kW systems, prices would actually move in retrograde, spiking beyond what they were back in August 2012.

Weighted average cost per watt ($/W) of a solar PV system in Australia over time. (Source: Solar Choice.)

There are admittedly a lot of assumptions in these numbers, and they are therefore only indicative. The government could, for example, simply cut the STC quota under the scheme, which could drive down STC prices and only weaken the incentive instead of completely gut it. (This is not an unlikely potential scenario given that many RET critics say that the scheme’s targets fail to account for the dramatic drop in overall electricity demand in Australia.) Furthermore, the prices are averages; impacts may vary by state and city. But they nevertheless give some indication of what the solar industry–and would-be solar homes and businesses–are up against in a worst-case scenario.

Low solar system prices are especially critical to the industry’s success in a world where other incentives have evaporated completely. The once generous feed-in tariffs that still existed in a number of states back in August of 2012 are no more, and with no reward for exporting excess solar power to the grid, the viability of the business case for going solar is heavily dependent low system prices. It is quite clear that is not yet time for the SRES to go.

What’s the takeaway from all this? Well, if you’re considering going solar in the near future, the answer to whether or not you should make a move before the RET review is over is either ‘Without a doubt’ or ‘Yes, definitely’.

Top image via Wikipedia

© 2014 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024