Origin Energy CEO Grant King has suggested that Australia should consider reducing its target of 20% renewable energy production by 2020 under the Federal Government’s Renewable Energy Target (RET). Thanks to rising electricity prices and expected associated demand reductions, plus accelerated uptake of rooftop solar PV systems and solar hot water, Origin claims that Australia will overshoot the target by 6%. But is this really the case?

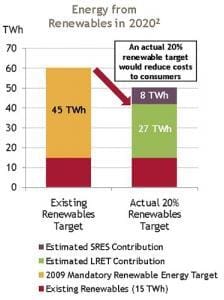

When the RET was created, it assumed that Australia’s national electricity demand in 2020 would be 300 terawatt-hours (TWh). King argues that, due to falling demand for power from the electricity grid, this number is likely to fall to 250TWh, meaning that the 20% target based on fixed generation figures as it currently stands will actually result in 26% of Australia’s power coming from renewable sources. In a presentation to Macquarie Australia conference in Sydney on 2 May 2012, Origin suggested that a 20% RET based on actual demand would reduce costs for the end-users of electricity. Reduced costs would come from “reduced requirements for expensive renewable generation, reduced network costs, and reduced requirements for peaking generation (required due to wind energy intermittency)”.

The timing of Origin’s suggestion for changes to the RET is slightly confounding, seeing as how it also issued a virtually simultaneous statement about the company’s having just signed made a commitment to purchase power from South Australia’s 270MW Snowtown II windfarm . The power purchase agreement (PPA) with Snowtown II is the largest renewable energy PPA to date in Australia.

Energy from renewable sources as planned under the RET and as suggested by Origin. (Image via Sydney Morning Herald.)

Advocates of renewable energy have rejected calls to alter or reduce the RET. Australian Solar Energy Society (AuSES) Chief Executive John Grimes responded to Origin’s proposal, saying “Nobody should be surprised that a big fossil fuel and coal seam gas company wants to scuttle the Renewable Energy Target. The Australian Government must ignore this ongoing campaign from vested interests and keep building our clean energy future.”

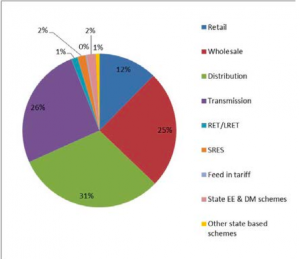

“Renewable energy schemes are only responsible for 3% of electricity prices rises across Australia, according to the Australian Energy Market Commission. Transmission and distribution and wholesale electricity costs make up a whopping 80% of the electricity cost increases.”

“Origin has wide-ranging fossil fuel investments, with exposure as Australia moves to a low carbon economy. Its recent rhetoric shows Origin is under pressure from an increasingly competitive solar industry.”

Tristan Edis of Climate Spectator has likewise cited vested interests as Origin’s main motivation for calling for a RET reductions. The company currently sits on a surplus of Renewable Energy Certificates (RECs). If the target is reduced, this surplus will mitigate Origin’s need to purchase or generate renewable energy. Electricity generators are required to submit a set number of RECs annually; these RECs can only be acquired by buying or generating renewable energy.

Because of a phenomenon called the merit order effect, solar power and wind power have the potential to eat into the profits of electricity retailers who rely on fossil fuels to meet peak electricity demand. This is not just an issue in Australia: Big electricity retailers in Germany are also crying foul in the face of competition from renewables, which can produce cheaper instantaneous electricity than conventional sources once they are operational. Large-scale deployment of renewables would reduce the profitability of their business models.

Meanwhile, the claim that electricity demand will fall by the amount suggested by Origin by 2020 remains in question. Michael Mazengarb of Global Voices Australia notes in response to Edis that the Australian Bureau of Resources and Energy Economics (BREE) predicts (pdf) that demand will actually be slightly higher than expected under the RET by the year 2020. “The onus is on Origin to substantiate their claims that electricity demand will be much less than expected (and not much higher than current levels) in 2020.”

© 2012 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024