No feed-in tariff? No problem: Reposit Power’s GridCredits software lets solar-plus-storage system owners sell power into the grid – at a premium.

Reposit Power is an Australian company whose goal is to help solar-plus-storage system owners get the most out of their systems – while remaining connected to the grid. Reposit’s innovative GridCredits software allows homes to sell their home’s stored electricity into the grid at premium rates – by participating in the National Electricity Market. Reposit’s game-changing software and technology promises to revolutionise how everyone – including homeowners, small businesses, electricity networks and electricity retailers utilise energy storage.

The case for staying grid-connected with solar-plus-storage

On their own, rooftop solar panels are a great way for homes and other premises to generate their own power and save money on their electricity bills. But as solar feed-in tariffs – the rates solar system owners get paid for selling solar into the grid – have dwindled to virtually nothing, system owners are seeking new ways to maximise the benefits of their solar energy.

For most people, the most obvious and attractive way to do this is by installing an energy storage system. Energy storage promises not only the ability to keep more of your precious solar power to yourself, but also the visceral satisfaction of gaining a higher degree of independence from electricity retailers – and in some cases severing ties with the grid altogether.

But no matter how much people talk about it, going off-grid is an extreme move, and not one to be taken lightly. It is also not a realistic financial option. While it may be feasible to install enough solar-plus-storage capacity to be energy self-sufficient on some days, being wholly reliant on sunshine has its downsides – especially during long stretches of inclement weather. Getting through a particularly long rainy stretch without the grid to fall back on would mean having a system that is designed to meet 3-4 days worth of your electricity needs (or more likely, installing a backup diesel generator). This means a much larger initial investment in a system, which means a significantly longer payback period. This defeats the main purpose of going solar, which for most people is to save money.

So in a nutshell: Although lots of homes and businesses would love to get off the grid, the finances don’t stack up in most cases. But what if there were another compelling economic reason to remain connected to the grid? This is exactly what Reposit Power is offering with its GridCredits platform.

Reposit Power’s GridCredits app lets you keep track of how much energy you’re selling into the grid – and how much money you’re making.

How GridCredits sweetens the deal

Reposit’s approach and technology – the first of its kind in the world – gives ordinary homes direct access to the National Electricity Market, which to date has been the domain of utilities. This means that any household or premises with a ‘Reposit Ready’ energy storage device will essentially be able to become an electricity market trader – and reap profits from ‘buying low’ and ‘selling high’, just like the big power companies do. Reposit’s software puts your energy storage device in constant communication with the NEM, so that it ‘knows’ when to sell electricity to maximise your profits, based on parameters such as your home’s energy consumption habits, weather, grid demand, and future energy prices. As a nice sugar hit amongst all that, you receive payment for your contribution as an energy trader.

The ultimate benefit of the GridCredits program is this: If your electricity retailer is offering only a paltry 6c/kWh for your exported solar power (which is the case almost everywhere in the country at this point), you can rest easy knowing that when your system is called upon to export power to the grid, you will be handsomely rewarded. Reposit Power’s co-founder Dean Spaccavento explains: “The grid has price spikes which can go as high as one hundred to 200 times a normal feed-in tariff. Reposit’s technology allows Australian households to trade in these markets, which until now have been the sole domain of big business.”

Homes are already earning GridCredits in Australia

And you can too: Ask your energy storage installer for a Reposit-compatible energy storage unit

Las year, Reposit Power launched a 6-home pilot program. These households are now trading their home’s stored energy on the grid using Magellan Power’s RES1 energy storage unit. Other energy storage devices (including Tesla’s Powerwall, LG, Toshiba and others) will also be compatible with Reposit.

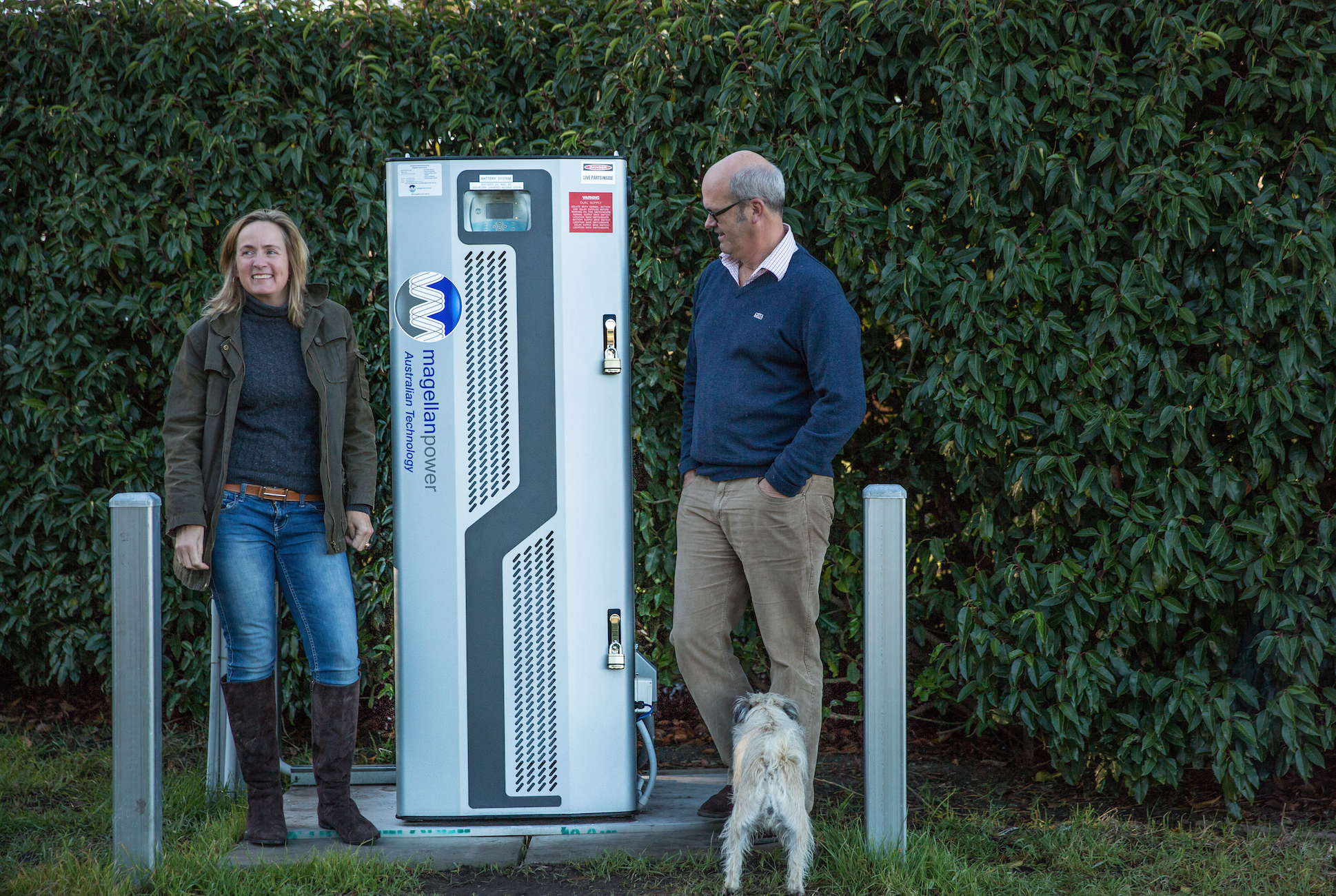

‘Jane and Dom’ in NSW use energy storage equipped with Reposit Power’s GridCredits to trade their property’s stored energy on the grid. (Image via Reposit Power)

Interested?

To get started, when you order your energy storage device, make sure you ask your installer for a Reposit version. Resposit-compatible energy storage devices are compatible with Reposit Power’s GridCredits software, which allows customers to sell their stored energy onto the grid.

If you are an installer who wants to help customers get set up with GridCredits so they can store, shift and trade energy on the grid, Reposit Power is building an installer ‘tribe’. Interested installers can express their interest in joining here.

© 2015 Solar Choice Pty Ltd

Can a Reposit Ready storage system be signalled to start up when the base load power is not available. This will be needed when we get to 100% renewable power and don’t have the capability to run the grid from only a few sources. The future is not what we have today. When the grid is not available, can you still communicate with the inverters? Have you come up with a system to start up the grid via these micro power stations? If not, are you working on this? This is an essential part of the future energy system and we should be solving these problems now. It would seem that we are not thinking far enough ahead.

Hi Andrew,

Reposit had a look at your question and responded with this article (which we recently published). Hope this clears things up and answers your questions!

Just wanted to know that does this mean that whatever the spot market rates are they would be the selling price for the storage customer? also do you have a calculation on payback for the energy storage unit plus are we expecting other retailers apart from Diamond energy to come on board ? sorry for so many questions

Hi Syed,

Apologies for the delay in getting back to you. You might be interested in seeing our recent article about the benefits of ‘Selective Export‘, which is the generic term we came up with to describe what Reposit Power does.

Additionally, we’ve put together a ranked list of the best cities for battery storage in this article which might be of interest.

Hi

I always thought you are not allowed to export energy from your energy storage in Australia. So you are basically saying here that there is currently only one electricity retailer permitting that and this will be changing with time. Is this correct?

Hi Amir,

As far as we’re aware, Diamond Energy is currently the only electricity retailer giving out payments for exported stored energy at the moment (the plan is called GridCredits 100 and it was developed in tandem with Reposit). There might be some that we’re not aware of, but that’s unlikely as it would have made big news just like Reposit’s GridCredits did when they launched.

Is this available in Queensland?

Hi John,

Currently, Diamond Energy is the only electricity retailer that we are aware of who are offering a retail package that takes advantage of GridCredits. Diamond does have offerings in QLD, but I believe that it’s only a trial program and allows only a limited number of applicants. Probably worth looking into, however!

Our understanding is that as time goes on, more and more retailers will be offering GridCredits packages.

How can we sent the power supply to grid and How can we Earn the credits could you please mention it with a calculation per unit?

Hi Santhosh,

Selling into the grid during peak pricing events is possible for homes with a battery bank and Reposit Power’s technology. Currently, the only electricity retailer offering a GridCredits program is Diamond Energy. They pay 100c/kWh during peak pricing events, but do not indicate how frequent these events may be. We’ll learn more as time goes on and more people deploy the technology, I’m sure.

Please sign this partition to make PV and storage mandatory for all new homes.

https://www.change.org/p/state-governments-of-australia-federal-minister-for-the-environment-greg-hunt-premier-of-victoria-daniel-andrews-premier-of-western-australia-colin-barnett-premier-of-nsw-mike-baird-premier-of-mandatory-installation-of-solar-panels-with-storage-on-al

Why is there no mention in your article or anyone else’s about buy back rates or even a graph of average rates over the last month/hour and cumulative /day

Hi PJ,

We currently have in the works a Q&A article with Reposit Power that seeks to get answers to some of the questions you’ve alluded to here. Please join our mailing list (form to the left of this page) to sign up for our weekly newsletter; the Reposit article will be included in our newsletter once we publish it.

How do I get this installed into my home in Canberra

Hi Ian,

You’d need to choose a battery storage device that is equipped with Reposit’s Gridcredits technology. Currently, these include Tesla’s Powerwall, Magellan’s devices, and LG Chem’s RESU.

You can see if any of the installers in our network offer any of these products in your area by filling out the Solar Quote Comparison Request form to the right of this page (by doing so, you can also compare battery options).