The New South Wales government has unveiled plans to offer electricity price guarantees to underpin the development of new renewable energy projects under the state’s Electricity Infrastructure Roadmap, that aims to drive 12GW of new generation capacity and 2GW of storage capacity by 2030.

As part of the $32 billion plan, the New South Wales government said new wind, solar, and storage projects that met the Roadmap’s criteria could be offered electricity price guarantees, including minimum energy prices, to act as an ‘investment safeguard’ for developers.

The Long Term Energy Services Agreements would include financial incentives for completing projects on time and could guarantee a minimum price for the electricity they produce, shielding them from low electricity prices and reducing the cost of capital. On the flip side, projects that failed to meet development deadlines would risk having their agreement terminated.

To help fund the electricity price guarantees, a new cost-recovery mechanism would be established through network charges paid by consumers, while a newly established Consumer Trustee would oversee competitive rounds for the selection of projects in line with the wider strategy.

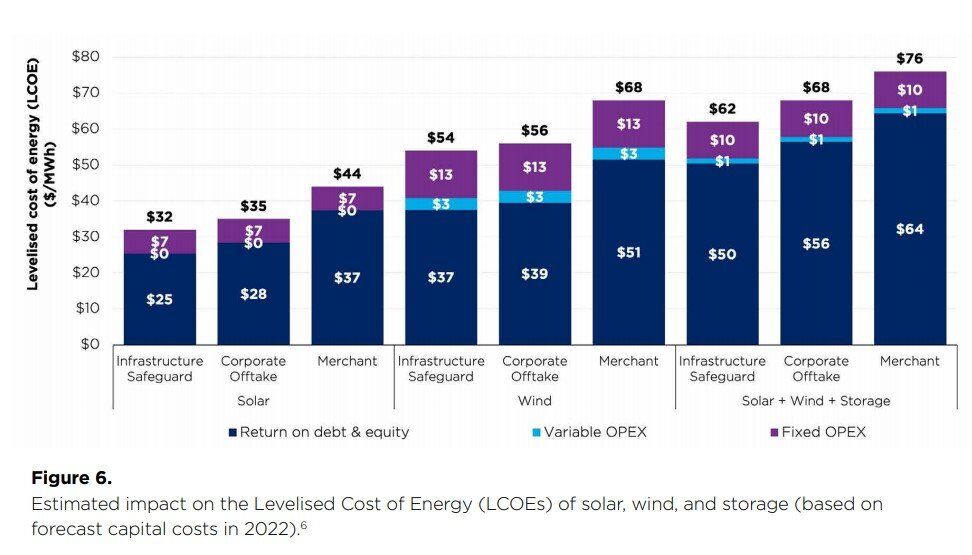

“As designed, the Infrastructure Safeguard will provide long term certainty for investors and lower the cost of capital. An optimised portfolio of capital-intensive infrastructure with zero fuel costs and low operating costs (e.g. solar, wind and pumped hydro) will further reduce the cost of capital,” the NSW Electricity Infrastructure Strategy says.

“The electricity price investors need to invest in 2023 is expected to be around 20 per cent lower if they have a Long Term Energy Services Agreement. The Infrastructure Safeguard will allow important factors such as location and community support to be factored into the decision criteria, thus contributing to the NSW Government’s wider policy goals.”

The NSW government commissioned analysis from NAB on the financial impacts of the investment safeguard, finding that the lower cost of finance for projects would substantially reduce the levelized cost of energy for wind, solar and storage projects, compared to projects operating on a merchant basis.