As more Australians embrace renewable energy, the Australian federal government continues to incentivise solar power adoption. Through the Renewable Energy Target (RET), homeowners and businesses can access federal government rebates and incentives to reduce the cost of solar installations. In 2024, you can benefit from two main federal programs: the Small-Scale Renewable Energy Scheme (SRES) for residential and small business installations, and the Large-Scale Renewable Energy Target (LRET) for commercial solar systems.

For a complete overview of all solar rebates and incentives available in Australia, visit our comprehensive guide on Solar Rebates.

Key Federal Government Solar Rebates / Incentives

- Small-Scale Renewable Energy Scheme (SRES): Designed to make solar more accessible for homeowners and small businesses, the SRES provides upfront savings through Small-Scale Technology Certificates (STCs).

- Large-Scale Renewable Energy Target (LRET): Ideal for larger commercial systems, the large-scale renewable energy target (LRET) enables businesses to earn ongoing revenue through Large-Scale Generation Certificates (LGCs), helping to offset long-term energy costs.

When combined with state-based rebates, these federal incentives can result in substantial savings. Let’s explore each program in more depth and how they can benefit you.

Small-Scale Renewable Energy Scheme (SRES): The Solar Rebate for Homeowners and Small Businesses

The SRES is a federal program that offers financial incentives for solar panel installations below 100kW, primarily targeted at residential and small business owners.

- Small-Scale Technology Certificates (STCs): Under the SRES, eligible solar systems earn STCs based on their projected energy production. These certificates effectively lower the upfront cost of solar installation by providing a “rebate” that installers typically apply to your bill.

- How STCs Work: Each STC represents one megawatt-hour (MWh) of power your system is expected to produce. The number of STCs you receive depends on your system’s size, location, and the amount of sunlight your area receives.

- Claiming Your SRES Rebate: Only solar systems installed by Clean Energy Council (CEC) accredited professionals qualify for STCs, ensuring high standards and safety. You can compare quotes from up to 7 installers in your area, ensuring you find the right fit.

Note: STCs decrease annually and will phase out by 2030, meaning the sooner you install, the greater your rebate.

Compare quotes from up to 7 installers in your area now.

Large-Scale Renewable Energy Target (LRET): Long-Term Revenue for Commercial Solar

The LRET is geared toward larger utility scale solar systems (over 100kW) often used by commercial enterprises.

- Large-Scale Generation Certificates (LGCs): Once installed, commercial solar systems generate LGCs based on the actual power produced, creating an ongoing revenue stream rather than a one-time rebate.

- How LGCs Work: These certificates are tradable and fluctuate in value depending on market conditions, offering a financial advantage as long as your system continues producing power. As of now, LGCs trade around $46.25, providing valuable revenue for businesses looking to offset operational costs.

- Requirements for LRET Eligibility: To generate LGCs, systems must undergo an accreditation process and meet reporting requirements. Once operational, your business can sell these certificates to energy retailers or other entities required to meet renewable energy quotas, creating a reliable source of income.

Environmental and Financial Impact: By investing in commercial solar, businesses not only benefit financially but also reduce their carbon footprint, contributing to Australia’s sustainability goals.

You can check the future outlook for LGC prices here.

Read more about the creation of LGCs.

Compare quotes from up to 7 installers in your area now.

Renewable Energy Target (RET) Overview: Australia’s Commitment to Clean Energy

The Renewable Energy Target (RET) aims to source a significant portion of Australia’s electricity from renewable sources. Divided into the SRES and LRET, this program incentivizes renewable energy adoption to reduce carbon emissions and foster sustainability.

How the RET Works:

The RET creates a market where renewable energy certificates (STCs and LGCs) act as a form of currency. As part of the RET, energy retailers and other large consumers must purchase a portion of their electricity from renewable sources.

Benefits of the RET:

- Environmental Impact: Solar incentives align with Australia’s goals to reduce emissions and increase reliance on renewable sources.

- Economic Advantages: As more Australians install solar, the demand for non-renewable energy decreases, potentially lowering energy prices over time.

- Energy Independence: Increased solar adoption helps Australia move toward energy independence and stability.

Why Act Now?

- Maximise Rebates: With STCs and LGCs phasing out by 2030, early adopters benefit the most from federal solar incentives.

- Increase Property Value: Homes and businesses with solar installations are often valued higher, attracting eco-conscious buyers and tenants.

- Reduce Energy Bills: By generating your own power, you’ll rely less on the grid, leading to immediate energy savings.

Installing solar in 2024 means not only cashing in on federal and state incentives but also making a positive environmental impact. If you’re ready to start, compare quotes from accredited installers today and take the first step toward a sustainable and cost-effective future with solar energy.

Ready to Go Solar? Get Started with a Quote From Solar Choice

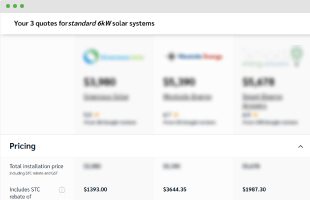

To take advantage of these federal incentives, contact an accredited installer and start your journey towards energy savings and sustainability. Comparing multiple quotes ensures you’re getting the best deal, helping you make an informed choice for a greener future.

Compare quotes from up to 7 installers in your area now.

- Home EV Chargers: Do you need one and what to look for? - 11 December, 2024

- Best VIC Solar Feed-In Tariffs - 11 December, 2024

- Best SA Solar Feed-In Tariffs - 11 December, 2024