For quite some time I’d dismissed the hype about the attractiveness of installing grid-connected batteries in Australia. Yes, everyone loves the idea of energy independence, and would love to give the middle finger to the electricity retailers who buy excess solar power at a fifth of the price they themselves charge. But I thought there would be few people willing to spend tens of thousands of dollars to do so. On top of that, though Tesla had created a surge of interest, most PV retailers were struggling to convert that into sales, or had limited product supply options.

When I surveyed the market in April 2016, respondents reported that only although half of solar power enquiries were asking about batteries, barely 2% of people who bought a solar power system actually bought a battery with it. Back in April, the median respondent forecast there to be 850 installations nationwide in 2016, totalling 28MWh; 75% of respondents expected fewer than 5500 installations would occur last year.

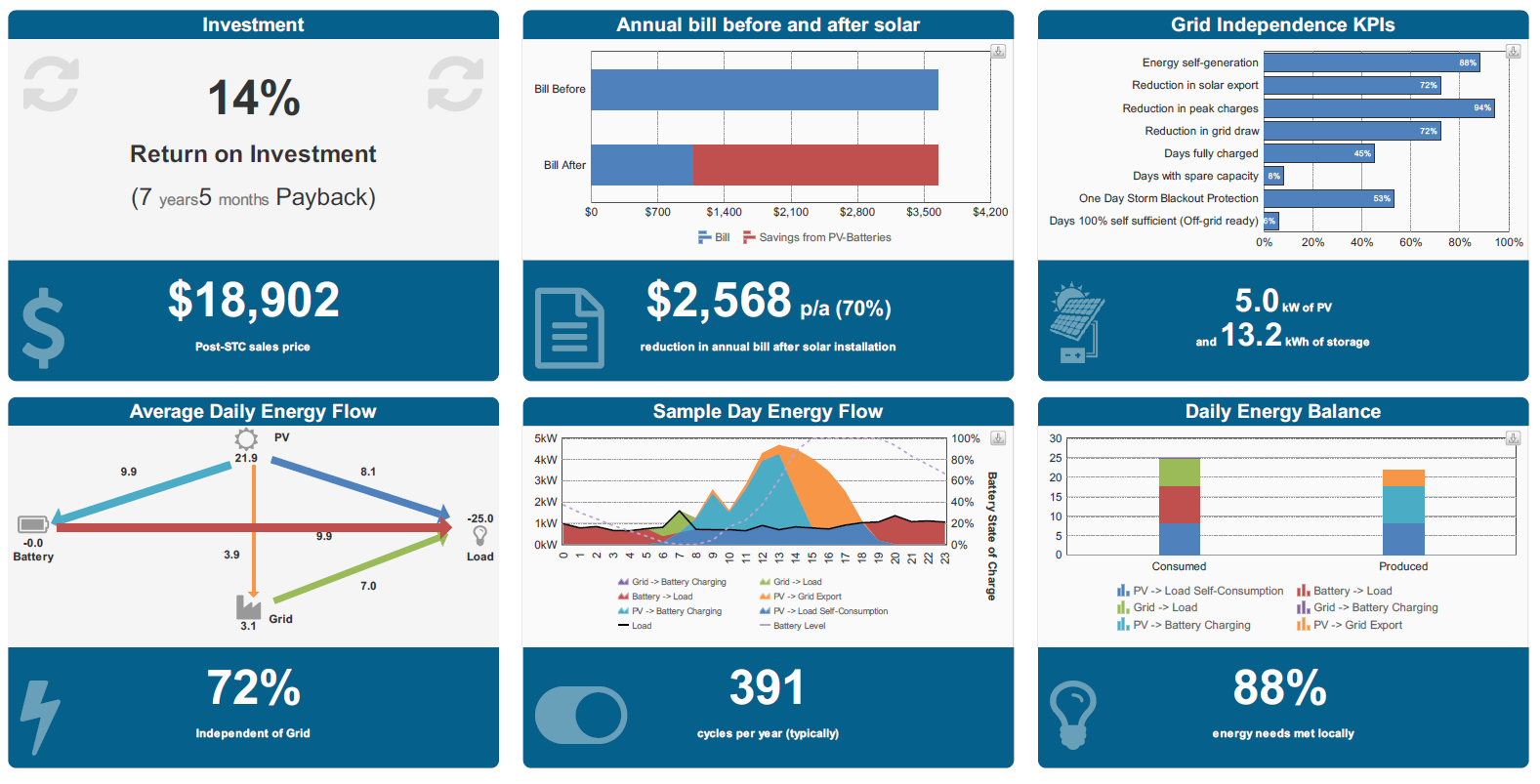

My what a difference half a year can make! In the second half of 2016, more products came to market, Tesla announced a major price drop, and lo and behold batteries became an affordable option (for some). Using SunWiz’s PVsell software, the dashboard below demonstrates that an Adelaide household can get a 7 year payback on a 5kW PV system with 13kWh of storage, if they have moderately high energy consumption (25 kWh/day). In the process, they can generate 88% of their energy needs, reduce their solar export by three-quarters, and reduce their grid draw by 72%.

Its no wonder that Australia is about to become one of the top countries in the world for battery installations.

But how do we know what’s actually been installed? Whereas the STC incentive means SunWiz can track PV installations with a high degree of accuracy and deep resolution, no such data source exists for batteries. While distribution network operators may seem the natural focal point of data collection, our discussions with network operators revealed they are largely unaware of the true volumes of batteries that are being installed on their network. So, in order to provide some transparency into what is otherwise a highly opaque market, SunWiz has had to personally interview over 60 battery market leaders. And by leveraging SunWiz’s status as trusted independent solar analyst, we have been given unprecedented amount of information (most of which we must keep confidential), and this has been compiled into a report that provides unparalleled insight.

The report shows:

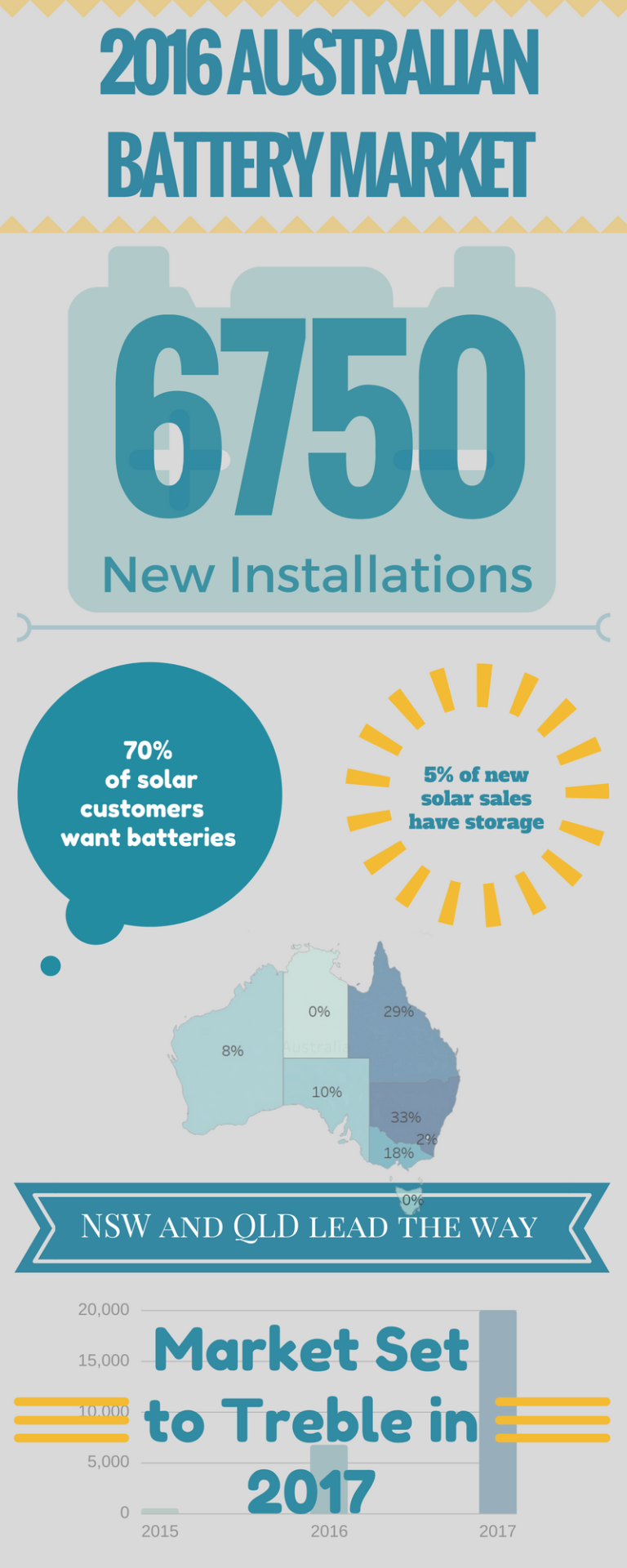

- 6750 battery installations occurred in 2016, up from 500 in 2015. This means that 5% of new PV systems included energy storage in 2016.

- New South Wales and Queensland led installations in 2016.

- Because most of the installations occurred in the latter part of the year, we are confident there will be at least a three-fold increase (and more likely a fourfold increase) on these number in 2017. This would mean one in five new PV installations in 2017 includes batteries.

- There was a record volume of capacity installed in major projects, rollouts, and distribution network trials.

Our full report provides a rich dataset of research, survey, and industry opinion that will inform the strategies of storage manufacturers, wholesalers and retailers for the year ahead. It includes a full details of the volumes installed in 2015 and 2016, forecasts for 2017 and beyond, commentary and insights into market trends, details of battery pricing and financials, a listing of the top ranks of manufacturers wholesalers and retailers, and comprehensive coverage of the key news of 2016. More information on the report can be found at http://www.sunwiz.com.au/index.php/battery-market-report-2017.html

This article originally appeared on the SunWiz website. Reproduced with permission.

- A look back at 2017: A year that smashed multiple Aussie solar records - 21 December, 2017

- A customer survey compares battery quality and brand recognition - 28 August, 2017

- Believe the Hype: Australia’s Battery Market set to skyrocket - 1 March, 2017