Federal government intervention to prop up coal power generation could damage the credit quality of the Australian energy sector, a new report has warned, just as it seeks crucial new investment in a rapidly changing grid.

The report, from financial markets analyst S&P Global Ratings, calls for an end to the federal energy policy vacuum, and for the reintroduction of emissions goals as a critical ingredient for planning the future grid.

It says that ongoing policy uncertainty, and the dumping of the proposed National Energy Guarantee, is delaying planned investment in new, quick dispatchable generation capacity across the NEM. And they’re not talking about coal.

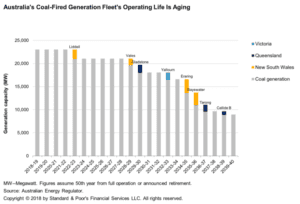

Indeed, the report says that any sort of investment in new coal power is highly unlikely, without government underwriting it.

“Potential regulatory intervention could limit incentives for market participants and negatively affect the sector’s credit quality over the longer term,” the report says.