Regulated electricity prices will rise in Queensland next year, and the carbon tax and other renewable energy support schemes have been widely blamed as the main reason for these increases. Indeed, a sans-carbon tax scenario would see these prices increase to a lesser degree, but the backlash against the unpopular law seems to have blinded many to another reality: gas prices are rising and are likely to continue to rise regardless of whether there is a carbon tax or not.

The top 3 justifications given for the forthcoming price increases (besides the carbon tax) given in the QCA’s report are wholesale fuel costs, the state’s Solar Bonus feed-in tariff scheme, and network upgrades. Of these 3, the first seems to have garnered the least attention. but it is arguably the most critical factor affecting long-term electricity prices. Queensland has become increasingly reliant on electricity generation from natural gas in recent years thanks to a boom in its production.

The top 3 justifications given for the forthcoming price increases (besides the carbon tax) given in the QCA’s report are wholesale fuel costs, the state’s Solar Bonus feed-in tariff scheme, and network upgrades. Of these 3, the first seems to have garnered the least attention. but it is arguably the most critical factor affecting long-term electricity prices. Queensland has become increasingly reliant on electricity generation from natural gas in recent years thanks to a boom in its production.

While there are obviously many factors influencing electricity prices, and wholesale fuel costs are only one of them, it is clear that fuel-free technologies like solar PV and wind power are not subject generation cost increases to the same degree that natural gas is–especially when considering the impact of demand from international markets. If wholesale gas prices are already driving up electricity prices for Queenslanders, what will prices look like 20 years down the line, especially when compared to the cost of generating power using technologies whose fuel cost does not fluctuate, and whose commissioning costs have been steadily coming down?

This is by no means a problem isolated to Queensland. As a network company representative pointed out in a RenewEconomy op-ed recently, big changes are underway in the electricity industry at large, and no one is sure how things are going look in the year 2030. A number of industry & government bodies have nevertheless speculated about what shape the electricity industry and its infrastructure will take in the next 20-30 years, and in most of these renewable technologies play an important role. The National Transmission Development Plan of Australia’s own Australian Energy Market Operator (AEMO), for example, anticipates that all new electricity generation capacity out to 2020 will be from renewables–mainly wind, followed by utility-scale solar PV plants and a small amount of biomass. The CSIRO imagines that renewables are certain to play a much expanded role in any number of possible future scenarios. CitiBank suggests that it will not be a case of selecting either renewables or gas, but instead that the technologies will support one another in a future energy mix. This is all on top of earlier reports by research firms like McKinsley and Goldman Sachs, to name a few, who have made similarly optimistic predictions about the future of renewable energy.

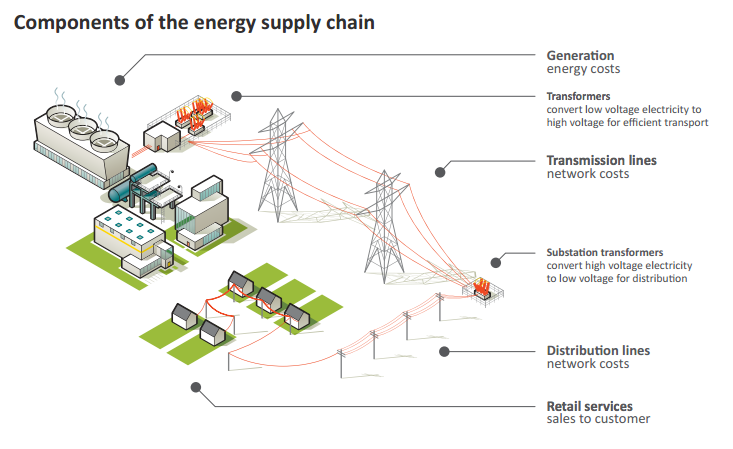

Image via QCA

© 2013 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024