US investment bank Morgan Stanley has predicted battery storage technology will be installed at rate four times quicker than Australia’s incumbent energy industry expects, in a new report.

The report, Asia Insight: Solar and batteries, reveals Morgan Stanley expects the market for battery storage to grow from about 2,000 Australian homes now to one million by 2020. But its “high case” suggests the take-up could be double that – up to 2 million homes by 2020.

“We think most incumbent utilities downplay the earnings risks from solar and battery take-up, and the market has not yet priced in the retail and wholesale market effects,” the company analysts write in their report.

The findings of Morgan Stanley are almost diametrically opposed to most in the industry – the incumbent utilities and regulators included. It admits itself that its estimates are by far the most aggressive on the “street” (meaning among investment banks).

Last week, the Australian Energy Market Operator predicted 6.6GWh of battery storage in Australia by 2035. That’s the figure that Morgan Stanley says will be reached by 2020, although AEMO’s trajectory corresponds with Morgan Stanley’s “low uptake” scenario.

Most utilities still downplay battery storage as a “medium term” opportunity, saying the “payback” would not occur for another five years at least. Some say 10 years. One state regulator even refused to consider battery storage in its current regulatory approval because it didn’t think the technology “had arrived”.

Morgan Stanley also believes that the solar market will remain strong, that electricity tariffs will remain high and that consumers will be attracted to the battery storage technology.*9/*-

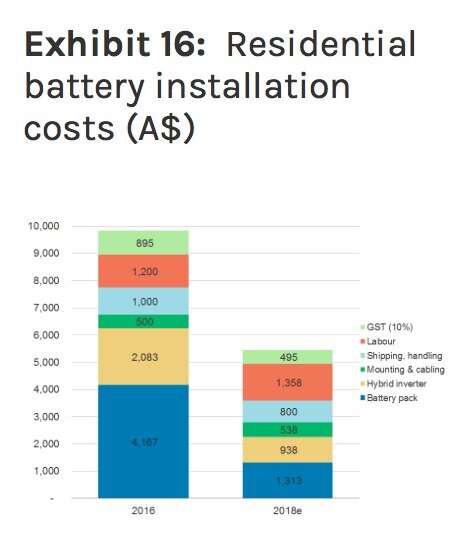

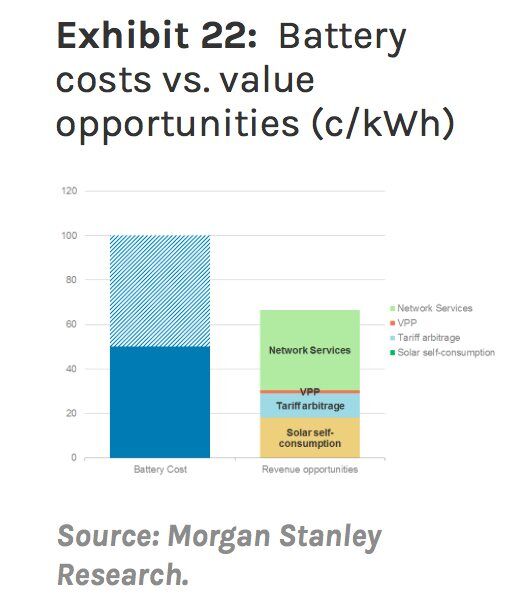

Battery storage installation costs, Morgan Stanley believes, are likely to fall by 40 per cent within two years, and changing business models and tariffs mean that these could be revenue positive by that time. (More detail in this article here).

That 40 per cent fall is likely to trigger the start of the “mainstream” market in 2018, a “tipping point” for the market that is expected to double the following year as costs fall further, more retrofits on existing solar systems occur and as consumers start to access payments for network services.

© 2016 Solar Choice Pty Ltd