Small-scale Technology Certificates (STCs) is the official term of what is commonly deemed Australia’s residential solar rebate. STCs are a component of the federal governments Small-scale Renewable Energy Scheme (SRES), this is the specific individual and small business component of the Australian Government’s Renewable Energy Target (RET). By offering STC rebates, this program helps offset the upfront costs of solar installations, making it easier to invest in clean, renewable energy.

The number of STCs you can claim depends on several factors, including your system’s size, geographic location, and installation date and others. Using an STC calculator, you can estimate the number of certificates your solar project will generate. These certificates hold real value, as energy companies are required to purchase them, keeping the market for STCs active and ensuring competitive pricing.

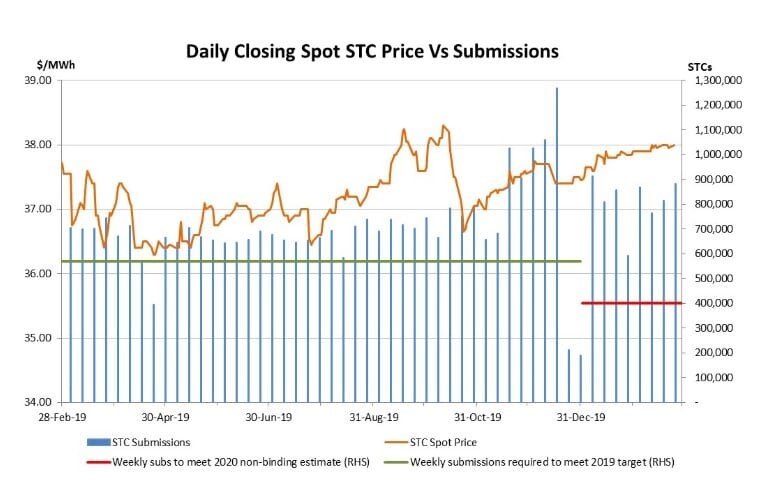

As STC prices fluctuate based on supply and demand, it’s important to understand how this impacts your solar savings. Whether you are upgrading your current system or installing solar for the first time, navigating the STC solar market can significantly reduce your investment costs.

In this guide, we’ll break down everything you need to know about STCs, the STC rebate system, how to calculate your savings, and how the small-scale renewable energy scheme benefits Australian solar adopters.

For a complete overview of all solar rebates and incentives available in Australia, visit our comprehensive guide on Solar Rebates.

What are STCs?

STC’s are created upon installation of a Solar PV System with a solar panel capacity under 100kW. The number of STCs created is dependent on the solar system’s size and geographical location.

The created STCs can be sold in a live market which is used to reduce the cost of the installation to the home or business owner. In practice, Solar Installers normally take ownership of the created STCs and simply charge the customer for the difference.

These certificates have a monetary value because energy companies are required by law to buy a certain number of STCs each year to meet their renewable energy targets.

By selling your STCs, you’re helping these companies meet their obligations, and in return, you get money that reduces the cost of your solar installation. Most of the time, your solar installer will sell the STCs for you and use the money to give you a discount on the system.

Can you trade STCs yourself?

The other method is to register with the REC and create the STCs yourself, this costs $20 and requires proof of system ownership and eligibility. After completing this process, the STCs can be traded like stocks on an open market or through what’s called the ‘clearing house’, however, this can take up to 12 months.

Generally speaking, it is much easier and will result in a better outcome by passing your STCs to an honest and reputable installer. They can trade STCs in large bulk parcels and access better pricing through a broker.

Compare quotes from up to 7 installers in your area now.

What is the current STC rebate Price?

As the STCs are traded on an open market it is exposed to fluctuations. The historic low that an STCs price has fallen to is $16 a certificate. As of the day this article was written, the STC price was $38 a certificate. Click here to see the current STCs market price and the recent price history.

Above image sourced from RenewEconomy

What projects are eligible for an STC rebate

There are eligibility requirements under the Small-scale Renewable Energy Scheme that must be met to create STCs Criteria

- STC created within 12 months of installation

- Clean Energy Council approved inverter and solar panels

- Maximum 100kW DC capacity (nameplate rating of solar panels, not inverter)

- Adhere to local, state, and federal government legislation

- Uphold Australian and New Zealand standards

The following projects ARE eligible for STCs if the total system remains under 100kW in capacity:

- creating additional capacity or upgrading

- installing an additional separate system, and

- replacing an additional system

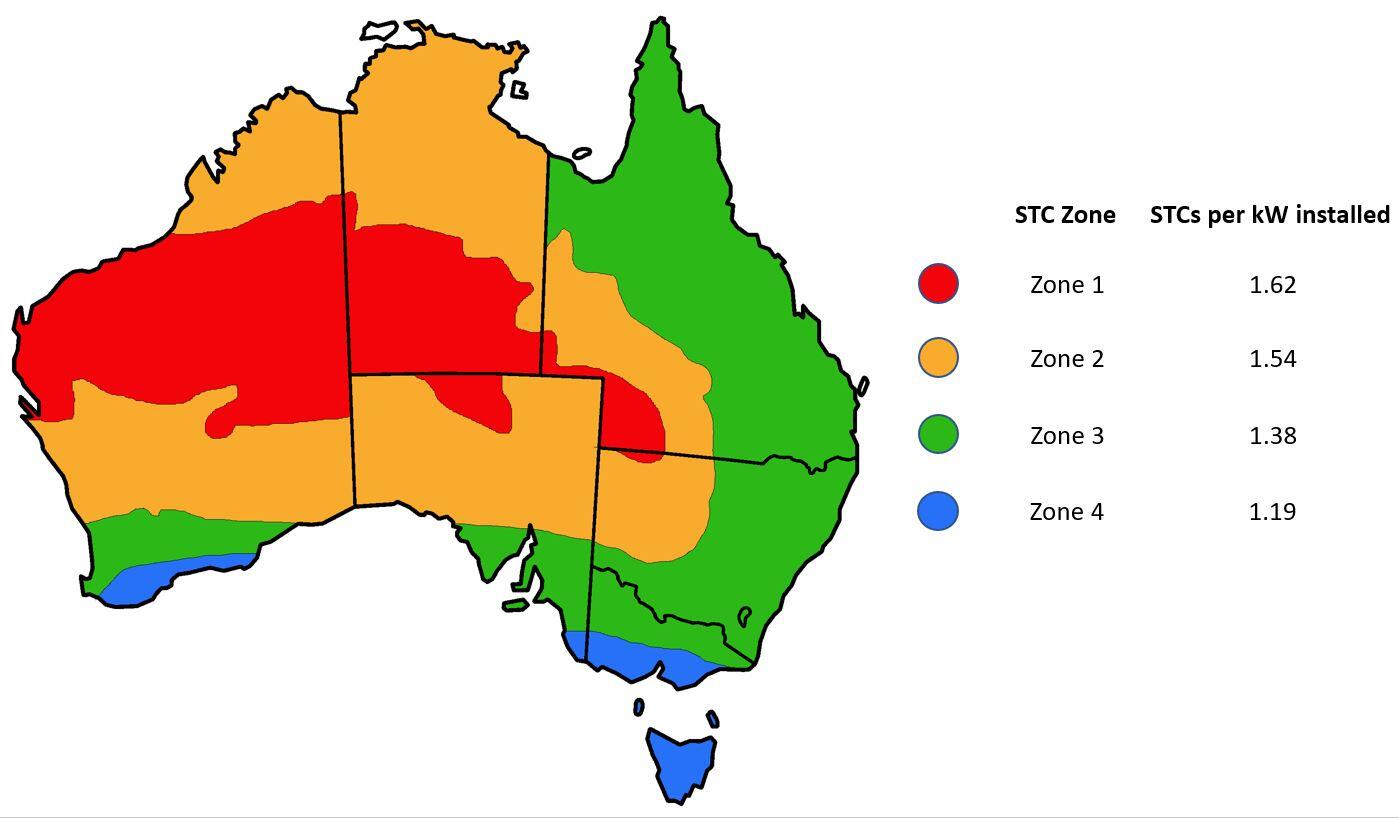

Geographic Location (Zones)

The geographic location of where the system is important to the STCs calculation, as different parts of the country generate vastly differing amounts of renewable energy. For example, Darwin is going to be able to generate more solar power than Hobart and is therefore able to receive a larger rebate.

Instead of calculating the sun radiance in every postcode, Australia has been split into four zones with a different ratings and multiplier for the creation of STCs. As of January 1st this year certain postcodes have changed zones, to check the updated postcode zones click here.

Installation Date & Deeming Period

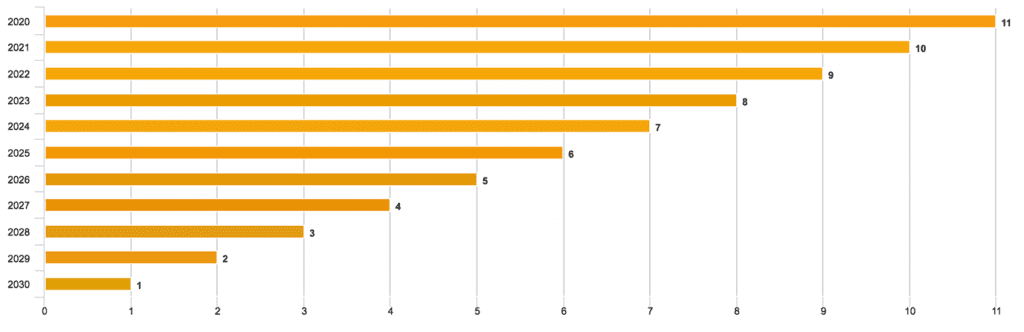

The installation date determines the “deeming period” and factors into the calculation of how many STCs your project will create. The deeming period is the renewable energy created during the period up until 2030 when the Small-scale Renewable Energy Scheme is designed to phase out. As per the below graph each year the deeming period will reduce by 1 and be reflected in the number of certificates created.

STCs decrease on 1st January every year

Every year on January 1st the number of available STCs per project reduces. This only influences the number of certificates created, not the price of a certificate. Each year this will only increase the end price of a solar system to the customer by around 4-5%, but provides an incentive to get solar installed today!

How STCs Are Calculated

The number of Small-scale Technology Certificates (STCs) you receive for your solar installation depends on several key factors. Understanding these can help you maximize your rebate and make informed decisions about system sizing, location, and timing. Here’s a breakdown of how STCs are calculated:

Factors Affecting STC Calculation

- System Size:

The capacity of your solar PV system directly impacts the number of STCs generated. Larger systems produce more energy, resulting in a higher number of STCs. - Installation Location (STC Zone):

Australia is divided into four zones, each with different STC multipliers based on sunlight exposure. Locations with more sunlight generate more STCs. For example, systems installed in Northern and Central Australia (Zone 1) will earn more STCs than those in Melbourne and Tasmania (Zone 4). - Deeming Period (Years Remaining Until 2030):

The SRES program is scheduled to end in 2030, so the deeming period—the number of years remaining until 2030—affects the total STCs your system can generate. Each January 1, the deeming period reduces by one year, lowering the number of STCs generated. This annual decrease typically impacts the rebate amount by around 4-5%. - Expected Energy Generation:

STCs are based on the expected output of your solar system. For each megawatt-hour (MWh) your system is expected to produce, you earn one STC. The Clean Energy Regulator provides multipliers for each zone to simplify this calculation.

STC Calculation Formula

To calculate the number of STCs your system will generate, use this basic formula:

Postcode Zone Rating x Deeming Period Years x System Size in kW = Number of STCs created

For example, a 6.6kW solar panel system installed in Sydney (Zone 3) would generate approximately 9.1 MWh per year. With the current deeming period (remaining years until 2030), this system could generate around 91 STCs. At the current STC price of $38, the rebate for this system would be approximately $3,458.

STC Price and Market Value

As of March 2024:

- Current Market Price: $38 per STC

- Typical Trading Range: $35 – $40 per STC

- Point of Sale Discount: The rebate is typically applied as an upfront discount to reduce the system’s purchase price.

The STC price fluctuates based on market demand, although changes are less frequent than in currency or stock markets. Installers generally handle STC sales, passing the rebate on to customers as a discount on installation costs. When comparing quotes, focus on the final price rather than the STC value alone, as installers apply the rebate at the point of sale.

Example: STC Rebate for a Common System Size

The most common residential system size is a 6.6kW solar panel system with a 5kW inverter, which is often the maximum allowable size for single-phase connections. Here’s how STC rebates vary across Australia for a typical 6.6kW system:

| Location | STC Zone | Annual Generation (MWh) | STCs Created | Total Rebate @ $38 per STC |

|---|---|---|---|---|

| North West & Central Australia | 1 | 10.7 | 107 | $4,066 |

| Darwin, Central Australia | 2 | 10.1 | 101 | $3,838 |

| Brisbane, Sydney, Adelaide, Perth | 3 | 9.1 | 91 | $3,458 |

| Melbourne & Tasmania | 4 | 7.8 | 78 | $2,964 |

Note: These calculations are based on the current STC price of $38 and may vary if STC market prices fluctuate. Additionally, as each year progresses, the number of years in the deeming period reduces, which can slightly lower the rebate amount by 4-5% annually.

See the full postcode list on the Clean Energy Regular website

For more precise calculations, use an online STC calculator to estimate the number of STCs for your project based on system size, location, and installation date.

Important Updates for 2024

- STC Price Stability: The current STC price has stabilised around $38, up from previous years.

- System Cost Decrease: Solar system costs have continued to decline, making net installation costs lower despite the diminishing deeming period.

- Optimal System Sizes: The most common residential setup is now a 6.6kW system paired with a 5kW inverter.

- Zone Classifications Remain: The Clean Energy Regulator maintains four distinct zones to calculate STC rebates based on location.

Understanding these factors can help you make informed decisions when planning your solar installation

Can I Claim STCs More Than Once?

In some cases, you can claim STCs more than once, but it depends on the system modifications. Here’s when you are eligible to claim STCs again:

- Adding More Panels: If you add more solar panels to your existing system while keeping the same inverter, you can claim additional STCs.

- Installing a Separate System: If you install a new solar system with new panels and a new inverter, even on the same property, you can claim STCs for the new installation.

- Replacing the Entire System: If you replace both your solar panels and inverter, you can claim STCs again for the new system.

Important Note: If you only replace your solar panels but keep the same inverter, you will not be eligible to claim STCs. This rule was changed in 2018 to prevent companies from abusing the system by installing low-quality panels and replacing them under warranty while still claiming STCs.

This could be a key addition to the section on STC eligibility, helping users understand when they can claim STCs in different scenarios.

STC Value and Annual Reduction

STC values decrease annually due to the phase-out of the Small-scale Renewable Energy Scheme in 2030. Until 2017, the STC value was calculated based on 15 years of your system’s emissions offset, but today it is calculated based on the remaining years until 2030.

For example, if you install a system in 2024, the deeming period would be 7 years (2024 to 2030). If you replace the system in 2028, the deeming period would be reduced to only 2 years, meaning you would receive fewer STCs for the same system size.

This section would expand on the existing content about the deeming period and how it affects the number of STCs you can claim, providing further insights into why STCs decrease every year.

What about state rebates for Solar?

STCs is a federal program that is available to all Australians in every state and territory. This can be combined with other grants and rebates that might be available in your particular region.

See the below links to learn about some of the other rebate programs:

- Victorian state solar and battery rebate

- South Australia home battery scheme

- All battery incentives across Australia

Compare quotes from up to 7 installers in your area now.

Frequently Asked Questions (FAQ)

What are STCs?

What are STCs for solar?

How are STCs calculated?

How many STCs per kW?

How much are STCs worth?

- The Top 5 Problems With Cheap Air Conditioning Quotes - 12 January, 2026

- Running Cost of Air Conditioners – Explained - 7 October, 2025

- Air Conditioner Rebate South Australia: What You Need to Know - 19 September, 2025