Are clean energy schemes driving up the price of electricity? In the case of the carbon tax, the answer seems pretty clearly to be ‘yes’–that’s what it was intended to do, initially at least. And even then, it certainly hasn’t been a catastrophe.

When it comes to the Renewable Energy Target, however, the association with increasing prices does not apply as plainly, despite recent comments by the Prime Minister to the contrary. And an article published yesterday by WattClarity adds more evidence to the pile that this is the case.

Much like the carbon tax, the RET makes conventional electricity generation (i.e. using coal and gas as fuel) more expensive–at least for now. It does so less directly, however: While the carbon tax is a levy placed on any non-renewable energy generation, the RET requires large, polluting entities–be they utilities or heavy industry–to purchase renewable energy (certificates), thus boosting the market for renewables. Certificate prices fluctuate in response to supply and demand.

Theoretically, as renewable energy deployment grows (thanks to the boost given by the RET), the cost of technologies decline, making renewables more cost-competitive and ultimately reducing the cost and cost-intensiveness of the scheme. It’s a relatively elegant, market-based approach to incentivisation that is self-regulating. And even right now, it doesn’t cost electricity consumers much money, accounting for only about 4% of the average bill.

The RET’s potential for reducing everyone’s power bills in the long-term (or at the very least keeping them lower than they would be otherwise) is significant. Most renewables, being fuel-free, will not be subject to the sort of price volatility that conventional power plants are likely to face at some point in the future. The government’s own consultant on the RET Review has even pointed out that the RET will keep electricity prices down. The dismantling of the RET, while unlikely, will in any case not necessarily result in a reduction in power bills.

One of the major ways that renewables help with retail electricity prices is to keep spot prices down–as they are already demonstrating that they can. During times of high demand–particularly daily peak demand–renewables (especially wind) can often underbid larger, fossil-fuel generators (the merit order effect). This can reduce the incidence and severity of high-demand events and pass the savings on to end-consumers.

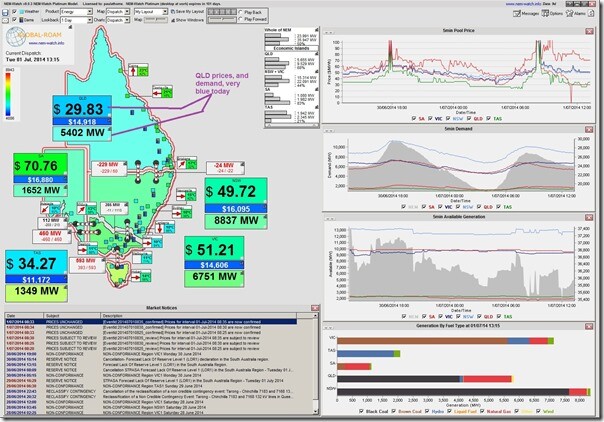

Small-scale, distributed energy systems like rooftop solar, combined with energy efficiency improvements can also have a big impact on peak demand, even though these don’t participate in the National Electricity Market (NEM). WattClarity, whose NEM-Watch software gives actionable insights into the electricity spot market, pointed this fact out last summer, when it noted that solar PV seemed to have prevented South Australia and Victoria from reaching new peak demand records during the worst of the 2014 heatwave.

WattClarity again points out that rooftop solar appears to playing a role in keeping prices low, this time in Queensland. The Author of the post, Paul McArdle, makes the caveat that solar may only be part of the reason for the low prices & demand (with a mass switching off of heating units being the other). One other possibility for the low prices (which “could not be much softer than this without being jelly”), he says, could be that generators are already beginning to strip out the carbon tax from their bids on the assumption that the tax will be successfully be repealed. Mr McArdle says that this doesn’t seem likely, however, going on to note:

“If this is not the case, then it does reveal how solar is really starting to cause a whole world of pain to existing generators in Queensland, and promising more.”

Electricity demand and spot prices: 1 July 2014. (Image via WattClarity)

Update 9 July 2014: Upon further analysis, WattClarity has determined that subtraction of the carbon price from market bids does appear to have been playing a significant role in the low prices of 1 July.

© 2014 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024