You are a solar PV system owner who is now considering adding battery storage. The options you have depend on a number of factors, and there are a range of situations that warrant different approaches – and have different outcomes.

In this article we take a look at some example situations that solar system owners might find themselves in with regard to retrofitting batteries. This piece focuses on Sydney, but is generally applicable to most of the rest of the country as well. We will be publishing similar articles for other capital cities in the coming weeks.

Compare solar & battery quotes from installers in your area

Compare Solar & Battery Quotes

Example battery retrofit scenarios for Sydney

No battery retrofit scenario will be exactly the same, but there are a few common situations that are worth examining. We’ve covered a handful of case studies below – but keep in mind that the best solution for you will depend on your circumstances & budget.

Click to expand to see assumptions used in these scenarios ▼

Scenario A: Existing 2kW solar system – Replace inverter, add 3kW solar & LG Chem RESU battery

You were one of the lucky NSW residents to gain access to the state’s Solar Bonus feed-in tariff scheme, but like every other beneficiary of the program your high rates (either 60c/kWh or 20c/kWh) ceased as of 1 January 2017. Now you’re looking at batteries as a way to soothe the blow of having your feed-in rate slashed.

You were one of the lucky NSW residents to gain access to the state’s Solar Bonus feed-in tariff scheme, but like every other beneficiary of the program your high rates (either 60c/kWh or 20c/kWh) ceased as of 1 January 2017. Now you’re looking at batteries as a way to soothe the blow of having your feed-in rate slashed.

And like many of the people in the same situation, you have a solar PV system on your roof that would be considered ‘small’ by today’s standards – 2kW as opposed to 5kW (now the most popular size for homes nationally).

With these points in mind, you decide to:

- Add 3kW of solar & replace existing inverter with a battery-compatible ‘hybrid’ inverter (total estimated cost of $4,500)

- Add an LG Chem RESU10 battery bank with usable capacity of 8.8kWh and a 10-year warranty (total estimated cost of $7,500)

Results:

Time of Use |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined | 6.4* | 18%* | $2,030 | $5,850* | $11,470* |

| Battery only | 8.5 | 13% | $1,000 | $520 | $4,100 |

| Solar only | – | -% | $1,370 | – | – |

Flat rate |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined | 7.3* | 15%* | $1,740 | $3,300* | $7,850* |

| Battery only | 11.6 | 7% | $690 | -$2,390 | $40 |

| Solar only** | – | -% | $1,400 | – | – |

*Note that these figures are inaccurate (too optimistic), as they also include the benefits of the original 2kW of solar panels; estimated savings (first year) should still be correct as an estimate.

**Also note that we’ve left out payback period & IRR figures in instances where the value delivered by the solar-plus-storage system includes the benefits of the pre-existing solar panels. Our aim in doing this is to separate the value attributable to the ‘old’ parts of the system as opposed to the parts of the system.

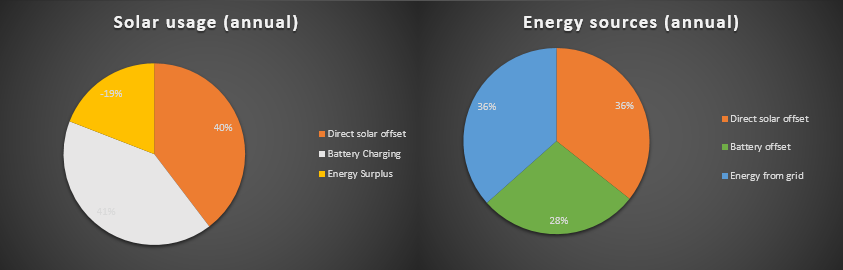

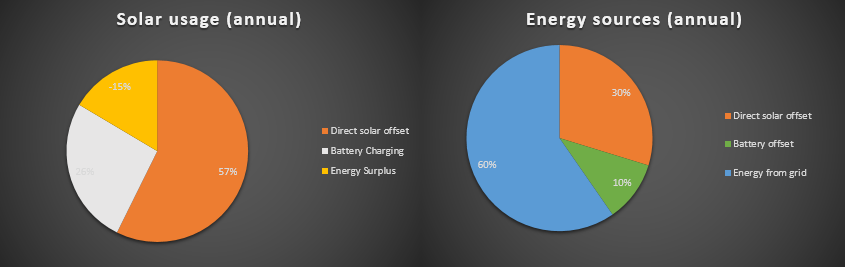

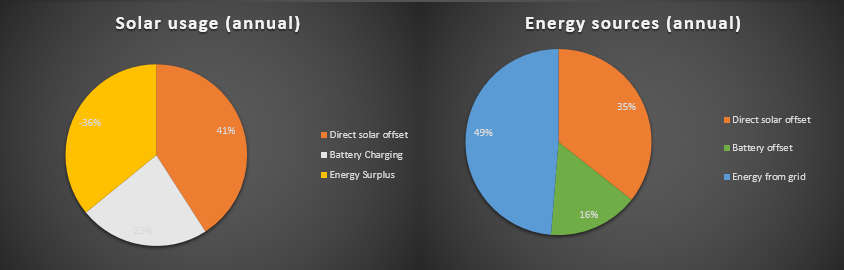

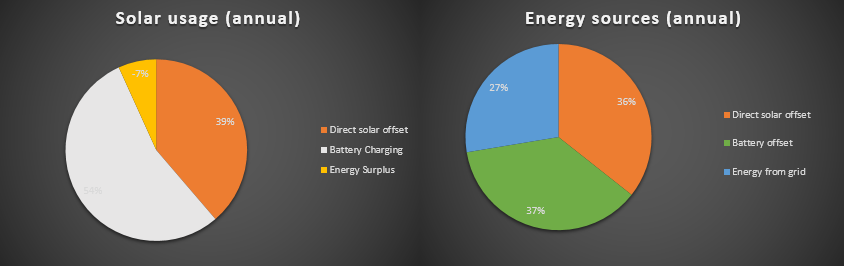

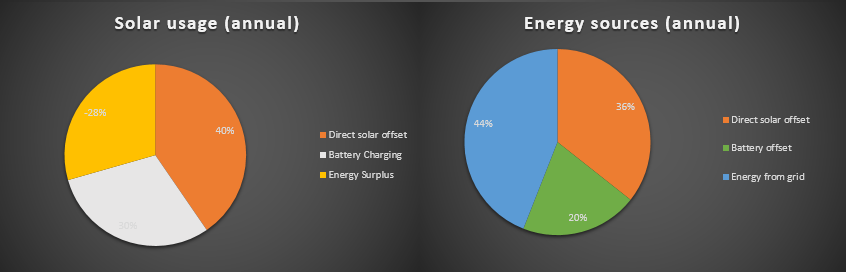

Estimated solar usage & energy source stats for first year (5kW solar & LG Chem RESU10)

Thoughts & comments:

Of all the scenarios we examine here, this may be the most favourable for adding batteries. Firstly, the addition of 3kW of solar to the existing system makes sense on its own for a house with a high consumption level of 25kWh per day. Secondly, as the original 2kW solar system approaches its 5th year of operation, it may very well be worthwhile to replace the inverter (as many inverters from that period had a standard 5 year warranty). By paying a bit more for a hybrid inverter as opposed to a PV-only inverter, the system owner is in a perfect position to then add on a battery bank without some of the additional costs often required for a battery retrofit (e.g. those associated with adding in a second, battery-dedicated inverter/charger or all-in-one battery/inverter system).

It’s clear that the battery bank would offer the most value to customers on a TOU billing arrangement, delivering about $1,000 per year in savings (as opposed to about $700 on a flat/block rate). With an estimated payback period of 8.5 years, internal rate of return of 13% and net present value of about $500 (at year 10) or $4,100 (at year 13 – assuming the battery continues to operate for 3 years after warranty expires) this is the best that can be hoped for with regard to batteries as an investment at current day prices. That being said, investing only in the solar expansion will deliver better overall returns – if slightly lower annual savings and less energy independence than a solar & battery system.

Also keep in mind that simply switching away from TOU billing to a flat/block rate may save you a significant amount from the outset.

Scenario B: Add 3.6 kWh Enphase AC Batteries to an existing 3kW system (no inverter replacement)

Now let’s assume that you’ve got a 3kW solar system already up on your roof and you want to add a small battery bank. Because your system is relatively new (only 2-3 years old), it doesn’t appear to make sense to swap out your fully operational, still-warrantied inverter – so you opt instead to install 3x of Enphase’s modular AC Battery units, each of which has its own integrated inverter. The estimated price for full installation is $6,000 for a total usable capacity of 3.6kWh.

Now let’s assume that you’ve got a 3kW solar system already up on your roof and you want to add a small battery bank. Because your system is relatively new (only 2-3 years old), it doesn’t appear to make sense to swap out your fully operational, still-warrantied inverter – so you opt instead to install 3x of Enphase’s modular AC Battery units, each of which has its own integrated inverter. The estimated price for full installation is $6,000 for a total usable capacity of 3.6kWh.

Results:

Time of Use |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combine¤ | – | -% | $1,200 | – | – |

| Solar only¤ | – | -% | $900 | – | – |

| Battery only | 13.1 | 6% | $400 | -$2,300 | -$750 |

Flat rate |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,100 | – | – |

| Solar only¤ | – | – | $960 | – | – |

| Battery only | >15 | 1% | $260 | -$3,660 | -$2,660 |

¤Note that we’ve left out payback period & IRR figures in instances where the value delivered by the solar-plus-storage system includes the benefits of the pre-existing solar panels. Our aim in doing this is to separate the value attributable to the ‘old’ parts of the system as opposed to the parts of the system.

Estimated solar usage & energy source stats for first year (3kW solar & 3.6kWh of Enphase AC Battery capacity)

Thoughts & comments:

While the batteries offer a better return on TOU billing, their payback period still outstrips their 10-year warranty and their net present value (NPV) may still be in the negative even at the 13-year mark. A quick glance at installing less capacity (2x units for 2.4kWh capacity at $4500) shows the returns being about the same.

To be fair, the high cycle life of these batteries should allow them to last up to 20 years if cycled (charged/discharged) only once daily, and further savings may be possible with ‘smart’ pre-charging on cheap off-peak rates – meaning that the outcomes could be better for the right households. Additionally, if the batteries were installed for $5,000 or even $5,500 the prospects over the long-term might look a bit rosier.

What might be a wiser option than batteries (as we’ve noted before) is to invest in expanding the existing system to 5kW by adding on 2kW of solar capacity (most likely with a second inverter) – and then look into batteries again in a few years’ time when prices have come down. In fact, 3kW is a rather small-sized system for batteries in the first place, and the addition of something like an energy management system or hot water diverter could easily go a long way towards getting more of the capacity you’ve already got.

Scenario C: Add GCL Poly E-Kwebe battery bank (& second inverter) to existing 5kW solar system

Many Australian households who have gone solar in the last few years opted to install 5kW systems – a size that is ample for the average home’s needs (and strikes a good balance between up-front costs & long-term returns). Let’s now assume that you have a 5kW solar system installed only about two years ago and that you’re keen to add a small battery bank to store some of your excess energy.

Many Australian households who have gone solar in the last few years opted to install 5kW systems – a size that is ample for the average home’s needs (and strikes a good balance between up-front costs & long-term returns). Let’s now assume that you have a 5kW solar system installed only about two years ago and that you’re keen to add a small battery bank to store some of your excess energy.

In this example we’ll use one of the most cost-competitive options on the market – GCL Poly’s E-KwBe – 4.5kWh of usable storage capacity with a 7 year warranty (one of the shortest of the lithium products currently available on the market). We’ll assume that you want to retain your existing inverter (which still has at least three more warrantied years of operation ahead of it) and install a dedicated inverter/charger for your new battery bank for a total installed cost of $5,500.

Results:

TOU |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,760 | – | – |

| Solar only¤ | – | – | $1,360 | – | – |

| Battery only | >20 | -4% | $600 | -$1,780 | -$1,780 |

Flat rate |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,590 | – | – |

| Solar only¤ | – | – | $1,400 | – | – |

| Battery only | >20 | -13% | $380 | -$3,100 | -$3,100 |

¤Note that we’ve left out payback period & IRR figures in instances where the value delivered by the solar-plus-storage system includes the benefits of the pre-existing solar panels. Our aim in doing this is to separate the value attributable to the ‘old’ parts of the system as opposed to the parts of the system.

Estimated solar usage & energy source stats for first year (5kW solar & 4.8kWh of capacity with GCL Poly E-KwBe battery)

Thoughts & comments:

Because of the battery’s short warranty period and low cycle life, it degrades faster than many others on the market, and despite the relatively low up-front price it does not appear to offer compelling value (at least in this situation). As a result, the returns in this scenario look particularly poor – although they might be improved slightly if the battery were to be installed on its own as part of a system already (or soon to be) fitted out with a hybrid inverter.

Scenario D: Adding Tesla Powerwall 2 to an existing 5kW solar system

Tesla’s Powerwall 2 is one of the most talked-about and in-demand battery storage products in Australia, offering 13.2kWh of storage capacity, a built-in inverter and of course Tesla’s shiny brand name emblazoned on its sleek exterior. At about $12,000 installed (the prices we’ve been seeing), it offers good value for money and comes with a 10 year warranty.

is one of the most talked-about and in-demand battery storage products in Australia, offering 13.2kWh of storage capacity, a built-in inverter and of course Tesla’s shiny brand name emblazoned on its sleek exterior. At about $12,000 installed (the prices we’ve been seeing), it offers good value for money and comes with a 10 year warranty.

For this scenario, we assume that your home has had a 5kW solar system installed less than 2 years ago, meaning that there’s no good reason to replace your existing inverter, which would still be under warranty. As such, one of the reasons you opt for the Powerwall is the fact that an external, additional inverter is not required; the battery & inverter come together in one neat package.

Results:

TOU |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | -% | $2,050 | – | – |

| Solar only¤ | – | -% | $1,360 | – | – |

| Battery only | 10.2 | 6% | $1,150 | -$1,980 | $380 |

Flat rate |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,850 | – | – |

| Solar only¤ | – | – | $1,400 | – | – |

| Battery only | 12.9 | 2% | $900 | -$4,100 | -$2,300 |

¤Note that we’ve left out payback period & IRR figures in instances where the value delivered by the solar-plus-storage system includes the benefits of the pre-existing solar panels. Our aim in doing this is to separate the value attributable to the ‘old’ parts of the system as opposed to the parts of the system.

Estimated solar usage & energy source stats for first year (5kW solar & 13.2kWh Tesla Powerwall 2)

Thoughts & comments:

A Powerwall 2 looks like it may reach the break even point at about the 10-year mark for customers on TOU billing (payback of 10.2 years), but the NPV with the parameters that we use could well still be in the negative at that point. Assuming that the battery continues to operate for another 3 years or so after that point, you are likely to come out ahead in real terms – albeit only slightly. For flat rate homes, even 13 years does not appear to be long enough to reach the break even point.

If you’re keen on a greater level of energy independence and shiny new tech, Powerwall 2 will probably attractive to you with returns in this range, but if you’re looking purely as an investment you may want to hold off.

Scenario E: Adding 6kWh Ampetus Super Lithium to existing, battery-ready 5kW solar system

Let’s now say that you went ahead an had a 5kW solar system with battery-ready inverter installed last year, and you’re keen to get batteries in ASAP to reduce the impact of the price hikes coming down the pipeline this year. Ampetus’ Super Lithium battery units might be a good option for you. They are available in discreet 3kWh ‘racks’ which can be fitted by a solar/battery installer in a custom cabinet or one of Ampetus’ off-the-shelf, pre-wired cabinets. Let’s say that you manage to get 2x of the battery racks in a cabinet for $5,000 with their standard 10-year warranty (extendable up to 15 years).

Let’s now say that you went ahead an had a 5kW solar system with battery-ready inverter installed last year, and you’re keen to get batteries in ASAP to reduce the impact of the price hikes coming down the pipeline this year. Ampetus’ Super Lithium battery units might be a good option for you. They are available in discreet 3kWh ‘racks’ which can be fitted by a solar/battery installer in a custom cabinet or one of Ampetus’ off-the-shelf, pre-wired cabinets. Let’s say that you manage to get 2x of the battery racks in a cabinet for $5,000 with their standard 10-year warranty (extendable up to 15 years).

Results:

TOU |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,890 | – | – |

| Solar only¤ | – | – | $1,370 | – | – |

| Battery only | 6.9 | 12% | $780 | $1,450 | $1,950 |

Flat rate |

|||||

| Simple payback period | IRR | Estimated saving (first year) | NPV @10yrs | NPV @13yrs | |

| Solar & battery combined¤ | – | – | $1,650 | – | – |

| Solar only¤ | – | – | $1,400 | – | – |

| Battery only | 10.2 | 3% | $500 | -$840 | -$530 |

¤Note that we’ve left out payback period & IRR figures in instances where the value delivered by the solar-plus-storage system includes the benefits of the pre-existing solar panels. Our aim in doing this is to separate the value attributable to the ‘old’ parts of the system as opposed to the parts of the system.

Thoughts & comments:

This could be a winning scenario for customers on TOU billing, with a simple payback period of about 7 years and a positive NPV at the 10 year mark. If your roof space is already ‘maxed out’ at 5kW, putting your money into batteries could make sense both in terms of maximising your savings and energy independence.

Estimated solar usage & energy source stats for first year (5kW solar & 6kWh of Ampetus Super Lithium battery)

General conclusions

As we’ve pointed out before, battery storage is close to where it needs to be for mass appeal, but making the case for a battery retrofit is highly dependent on your circumstances and the products that you choose. Some general observations are:

- Time of use customers will get more out of batteries than households on a flat rate – without even counting the additional benefits possible through pre-charging batteries on cheap off-peak rates in addition to solar charging. That being said, switching to a flat rate may be a smarter financial decision in the first place.

- Battery retrofits appear to make the most financial sense for households who have an existing solar system due for an upgrade (of which there are hundreds of thousands in Australia). Upgrading a system usually involves replacing an old inverter; by spending just a bit more on a hybrid inverter as opposed to a standard PV-only inverter, households put themselves in an ideal position to add a battery bank at a lower price than what might otherwise be possible (by avoiding the need for a second inverter or more expensive all-in-one system).

- Cycle life matters. The degradation model we use in our calculator anticipates that battery capacity drops off rapidly after the cycle life is exceeded – meaning that you can’t expect a battery to last long beyond its warranty unless its warrantied cycle life works out to more than once cycle per day (e.g. 1x cycle per day would be about 3,600 cycles over 10 years, while 2x cycles per day would be about 7,200 over 10 years). If you purchase a battery warrantied for 2x cycles per day, you can reasonably assume that it should last well past its warranty period if you only cycle it 1x per day over the first 10 years – while you can’t assume that as safely for a battery warrantied for only 1x cycle per day. So for those who are happy with the idea that the batteries will at least eventually ‘pay for themselves’ (e.g. over 13 years – the longest we examine here), choosing a battery bank with a high cycle life might be a good option.

Compare solar & battery quotes from installers in your area

Compare Solar & Battery Quotes

© 2017 Solar Choice Pty Ltd

- Solar Power Wagga Wagga, NSW – Compare outputs, returns and installers - 13 March, 2025

- Monocrystalline vs Polycrystalline Solar Panels: Busting Myths - 11 November, 2024

- Solar Hot Water System: Everything You Need to Know - 27 February, 2024

One thing I have noticed in all your comments about the benefits of solar and battery, is the cost of existing infrastructure for existing homes. It costs me, (even with no actual payments) on my bills, about one hundred and fifty dollars plus per quarter in Victoria. A mixture of systems has not talked about these quarterly compulsory payments unless one gets right out of commercial power. Can you comment on this? My system is over seven years old on 1.5 Kw/hr. I am thinking of changing over in three years, but with one eye to staying connected to the grid but using batteries and up-dated panels.

Hi Graham,

Fixed, daily ‘network charges’ are a fact of life for anyone connected to the grid. The easiest way to save money with solar (if you’re not on a generous, legacy feed-in tariff, as it sounds like you are) is to ‘self consume‘ the solar energy as it is being produced. This reduces your variable consumption charges (c/kWh), which are the largest component of the bill for many households.

To get rid of the fixed charges, you’ve got to either a) disconnect from the grid entirely or b) generate enough solar energy at a high enough solar feed-in rate to accumulate enough bill credits to cancel it out.

In either of these cases, you’re likely to need a sizeable solar PV system (not to mention battery storage if you go the off-grid route).

Both of these options are technically feasible but probably not realistic or attractive for most households (although a certain dedicated few are almost certainly doing just this already).

Hope this helps!